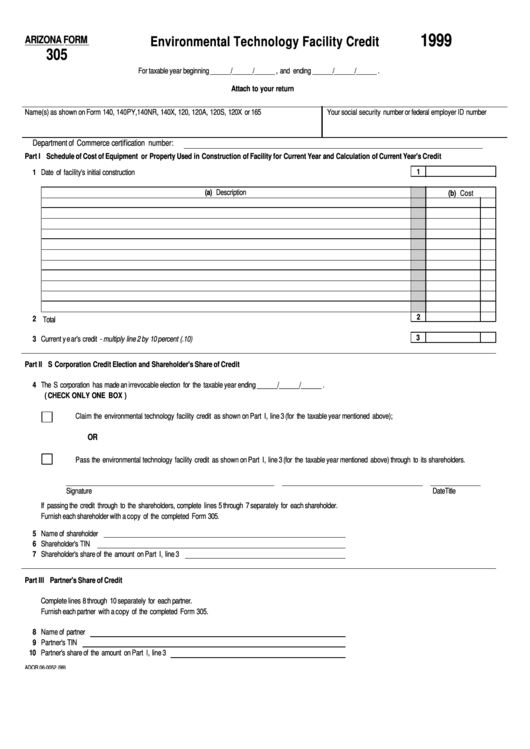

Arizona Form 305 - Environmental Technology Facility Credit - 1999

ADVERTISEMENT

1999

Environmental Technology Facility Credit

ARIZONA FORM

305

For taxable year beginning ______/______/______ , and ending ______/______/______ .

Attach to your return

Name(s) as shown on Form 140, 140PY,140NR, 140X, 120, 120A, 120S, 120X or 165

Your social security number or federal employer ID number

Department of Commerce certification number:

Part I Schedule of Cost of Equipment or Property Used in Construction of Facility for Current Year and Calculation of Current Year's Credit

1

1 Date of facility's initial construction

(a) Description

(b) Cost

2

2

Total

3

3 Current y ear's credit - multiply line 2 by 10 percent (.10)

Part II S Corporation Credit Election and Shareholder's Share of Credit

4 The S corporation has made an irrevocable election for the taxable year ending ______/______/______ .

( CHECK ONLY ONE BOX )

Claim the environmental technology facility credit as shown on Part I, line 3 (for the taxable year mentioned above);

OR

Pass the environmental technology facility credit as shown on Part I, line 3 (for the taxable year mentioned above) through to its shareholders.

Signature

Title

Date

If passing the credit through to the shareholders, complete lines 5 through 7 separately for each shareholder.

Furnish each shareholder with a copy of the completed Form 305.

5 Name of shareholder

6 Shareholder's TIN

7 Shareholder's share of the amount on Part I, line 3

Part III Partner's Share of Credit

Complete lines 8 through 10 separately for each partner.

Furnish each partner with a copy of the completed Form 305.

8 Name of partner

9 Partner's TIN

10 Partner's share of the amount on Part I, line 3

ADOR 06-0052 (99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2