Form Nc-478h - 2000 Tax Credit Low-Income Housing Page 2

ADVERTISEMENT

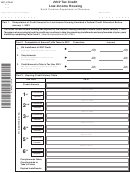

NC-478H Reverse

Part 2. Housing Credit History -

In the column for tax year 2000, list the eligible credit amount for which the taxpayer qualified in the

tax year, the amount of the installment taken, and the other information requested. An installment of a credit expires if the

taxpayer is no longer eligible for the corresponding federal credit. If a recapture of part of the corresponding federal credit is

required, a recapture of part of this credit is required.

2000

2001

2002

2003

2004

Tax Year

Eligible Credit Amount

Taken in 2000

Taken in 2001

Taken in 2002

Taken in 2003

Taken in 2004

Franchise

1

st

Income

Taken in 2002

Taken in 2003

Taken in 2001

Taken in 2004

Taken in 2005

Franchise

2

nd

I

ncome

Taken in 2004

Taken in 2002

Taken in 2003

Taken in 2005

Taken in 2006

Franchise

3

rd

Income

Taken in 2003

Taken in 2004

Taken in 2005

Taken in 2006

Taken in 2005

Franchise

th

4

Income

Taken in 2004

Taken in 2005

Taken in 2006

Taken in 2007

Taken in 2008

Franchise

5

th

Income

Taken in 2007

Taken in 2005

Taken in 2006

Taken in 2008

Taken in 2009

Franchise

th

6

Income

Carryforwards Taken

Carryforwards to

Take in Future

Expired Installments

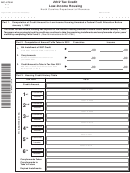

Part 3.

Computation of Amount Eligible To Be Taken in 2000

Franchise

Income

1.

1st Installment of 2000 Credit

,

,

.

,

,

.

00

00

From Part 1, Line 6; enter here and on Form NC-478, Part 1, Line 8

NC

478H

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2