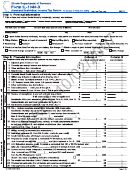

Delaware Form 200-01-X - Resident Amended Personal Income Tax Return - 1999 Page 2

ADVERTISEMENT

FISCAL YEAR _______/_______/_______ TO _______/_______/_______

Page 2

NOTE: IF YOUR ORIGINAL RETURN WAS FILED USING TWO SEPARATE FORMS, YOU MUST FILE TWO SEPARATE AMENDED FORMS

IS AN AMENDED FEDERAL RETURN BEING FILED?....................................................................................................

YES

NO

HAS THE DELAWARE DIVISION OF REVENUE ADVISED YOU YOUR ORIGINAL RETURN IS BEING AUDITED?...

YES

NO

IS THIS AMENDED RETURN BEING FILED AS A PROTECTIVE CLAIM?.....................................................................

YES

NO

A DETAILED EXPLANATION OF ALL CHANGES MUST BE PROVIDED IN THIS SPACE. ALL SUPPORTING SCHEDULES AND/OR DOCUMENTATION MUST BE ATTACHED.

CHILD CARE CREDIT WORKSHEET

ADDITIONAL STANDARD DEDUCTION WORKSHEET

1.

ENTER TOTAL AMOUNT FROM LINE 9, FEDERAL FORM

2441 OR LINE 9, SCHEDULE 2 (FEDERAL FORM

65 OR OVER

BLIND

TOTAL NO.

TOTAL AMOUNT

AND/OR SCHEDULE MUST BE ATTACHED)......................

1.

SELF......................

..............

.........

X 2500 =

2.

MULTIPLY THE AMOUNT ON LINE 1 BY 50%. ENTER

AMOUNT HERE AND ON PAGE 1, LINE 12 OF RETURN

2.

SPOUSE.................

................

.........

X 2500 =

NOTE: IF YOU ARE FILING A COMBINED SEPARATE RETURN, ENTER THE TOTAL FOR EACH AP-

NOTE: IF YOU AND YOUR SPOUSE FILE A JOINT FEDERAL RETURN BUT ELECT TO

PROPRIATE COLUMN. IF YOU ARE FILING A JOINT RETURN, ADD THE TOTAL OF LINES 1 AND 2

FILE SEPARATE OR COMBINED SEPARATE RETURNS FOR DELAWARE, THE CREDIT

AND ETNER ON PAGE 1, LINE 3.

IS ALLOWED TO THE SPOUSE WITH THE LOWER TAXABLE INCOME.

TAX RATE SCHEDULE

IF INCOME ON LINE 5 IS:

AT LEAST

BUT NOT OVER

YOUR TAX IS:

$

0.

$

2,000.

$

0.

2.60% OF AMOUNT OVER $2,000.

2,000.

5,000.

$78.00 + 4.30% OF AMOUNT OVER $5,000.

5,000.

10,000.

$293.00 + 5.20% OF AMOUNT OVER $10,000.

10,000.

20,000.

$813.00 + 5.60% OF AMOUNT OVER $20,000.

20,000.

25,000.

$1,093.00 + 5.95% OF AMOUNT OVER $25,000.

25,000.

60,000.

$3,175.50 + 6.40% OF AMOUNT OVER $60,000.

60,000 AND OVER

TELEPHONE AND ADDRESS INFORMATION

NEW CASTLE COUNTY

KENT COUNTY

SUSSEX COUNTY

Carvel State Office Building

Thomas Collins Building

422 North DuPont Highway

820 North French Street

540 South DuPont Highway

Suite 2

Wilmington, DE 19801

Dover, DE 19901

Georgetown, DE 19947

(302) 577-8200

(302) 739-1085

(302) 856-5358

Toll-free telephone number (Delaware only) 1-800-292-7826

(REVISED 11/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2