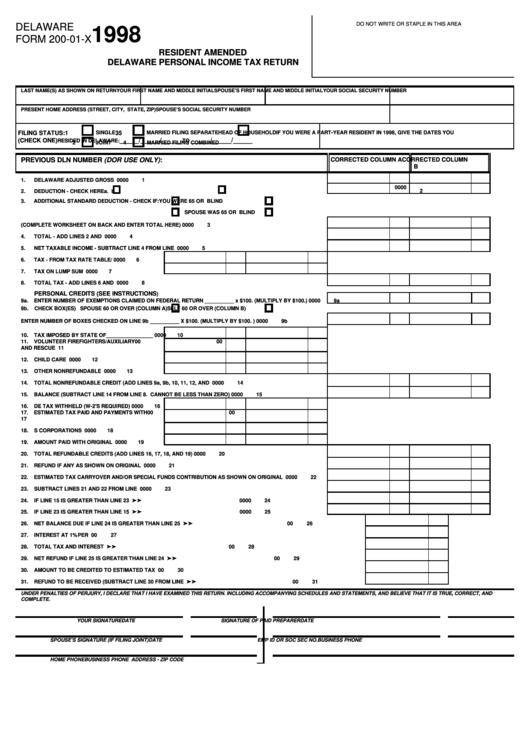

DO NOT WRITE OR STAPLE IN THIS AREA

DELAWARE

1998

FORM 200-01-X

RESIDENT AMENDED

DELAWARE PERSONAL INCOME TAX RETURN

LAST NAME(S) AS SHOWN ON RETURN

YOUR FIRST NAME AND MIDDLE INITIAL

SPOUSE’S FIRST NAME AND MIDDLE INITIAL

YOUR SOCIAL SECURITY NUMBER

PRESENT HOME ADDRESS (STREET, CITY, STATE, ZIP)

SPOUSE’S SOCIAL SECURITY NUMBER

FILING STATUS:

1

SINGLE

3

MARRIED FILING SEPARATE

5

HEAD OF HOUSEHOLD

IF YOU WERE A PART-YEAR RESIDENT IN 1998, GIVE THE DATES YOU

_____/_____/_____

_____/_____/_____

(CHECK ONE)

RESIDED IN DELAWARE:

TO

2

JOINT

4

MARRIED FILING COMBINED

CORRECTED COLUMN A

CORRECTED COLUMN

PREVIOUS DLN NUMBER (DOR USE ONLY):

B

1.

DELAWARE ADJUSTED GROSS INCOME...........................................................................................................

00

00

1

00

00

2.

DEDUCTION - CHECK HERE

a. STANDARD...............................

b. ITEMIZED...................................

2

3.

ADDITIONAL STANDARD DEDUCTION - CHECK IF:

YOU WERE 65 OR OVER..........

BLIND

SPOUSE WAS 65 OR OVER......

BLIND

(COMPLETE WORKSHEET ON BACK AND ENTER TOTAL HERE)..........................................................................

00

00

3

4.

TOTAL - ADD LINES 2 AND 3..........................................................................................................................

00

00

4

5.

NET TAXABLE INCOME - SUBTRACT LINE 4 FROM LINE 1.................................................................................

00

00

5

6.

TAX - FROM TAX RATE TABLE/SCHEDULE..........

00

00

6

7.

TAX ON LUMP SUM DISTRIBUTION.....................

00

00

7

8.

TOTAL TAX - ADD LINES 6 AND 7...................................................................................................................

00

00

8

PERSONAL CREDITS (SEE INSTRUCTIONS

)

9a.

ENTER NUMBER OF EXEMPTIONS CLAIMED ON FEDERAL RETURN __________ x $100. (MULTIPLY BY $100.).......

00

00

9a

9b.

CHECK BOX(ES) SPOUSE 60 OR OVER (COLUMN A)

SELF 60 OR OVER (COLUMN B)

ENTER NUMBER OF BOXES CHECKED ON LINE 9b __________ X $100. (MULTIPLY BY $100. ).............................

00

00

9b

10.

TAX IMPOSED BY STATE OF________________......

00

00

10

11.

VOLUNTEER FIREFIGHTERS/AUXILIARY

00

00

AND RESCUE CREDIT.........................................

11

12.

CHILD CARE CREDIT..........................................

00

00

12

13.

OTHER NONREFUNDABLE CREDITS.....................

00

00

13

14.

TOTAL NONREFUNDABLE CREDIT (ADD LINES 9a, 9b, 10, 11, 12, AND 13.......................................................

00

00

14

15.

BALANCE (SUBTRACT LINE 14 FROM LINE 8. CANNOT BE LESS THAN ZERO)....................................................

00

00

15

16.

DE TAX WITHHELD (W-2'S REQUIRED)................

00

00

16

17.

ESTIMATED TAX PAID AND PAYMENTS WITH

00

00

EXTENSIONS.....................................................

17

18.

S CORPORATIONS PAYMENTS...........................

00

00

18

19.

AMOUNT PAID WITH ORIGINAL RETURN............

00

00

19

20.

TOTAL REFUNDABLE CREDITS (ADD LINES 16, 17, 18, AND 19).......................................................................

00

00

20

21.

REFUND IF ANY AS SHOWN ON ORIGINAL RETURN..........................................................................................

00

00

21

22.

ESTIMATED TAX CARRYOVER AND/OR SPECIAL FUNDS CONTRIBUTION AS SHOWN ON ORIGINAL RETURN........

00

00

22

23.

SUBTRACT LINES 21 AND 22 FROM LINE 20...................................................................................................

00

00

23

IF LINE 15 IS GREATER THAN LINE 23 ENTER........................................................................ BALANCE DUE ' '

24.

00

00

24

25.

IF LINE 23 IS GREATER THAN LINE 15 ENTER.......................................................................OVERPAYMENT ' '

00

00

25

NET BALANCE DUE IF LINE 24 IS GREATER THAN LINE 25 ENTER...........................................................NET BALANCE DUE ' '

26.

00

26

27.

INTEREST AT 1% PER MONTH.............................................................................................................................................

00

27

TOTAL TAX AND INTEREST DUE....................................................................................................................PAY IN FULL ' '

28.

00

28

29.

NET REFUND IF LINE 25 IS GREATER THAN LINE 24 ENTER..................................................................NET OVERPAYMENT ' '

00

29

30.

AMOUNT TO BE CREDITED TO ESTIMATED TAX ACCOUNT.....................................................................................................

00

30

REFUND TO BE RECEIVED (SUBTRACT LINE 30 FROM LINE 29..........................................................................NET REFUND ' '

31.

00

31

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN. INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND BELIEVE THAT IT IS TRUE, CORRECT, AND

COMPLETE.

YOUR SIGNATURE

DATE

SIGNATURE OF PAID PREPARER

DATE

SPOUSE’S SIGNATURE (IF FILING JOINT)

DATE

EMP ID OR SOC SEC NO.

BUSINESS PHONE

HOME PHONE

BUSINESS PHONE

ADDRESS - ZIP CODE

1

1 2

2