Form K-19 - Report Of Nonresident Owner Tax Withheld - 2012

ADVERTISEMENT

2012

K-19

REPORT OF NONRESIDENT OWNER TAX WITHHELD

(Rev. 9/12)

Tax year ending date of Partnership, S Corporation, LLC or LLP __________________________________ .

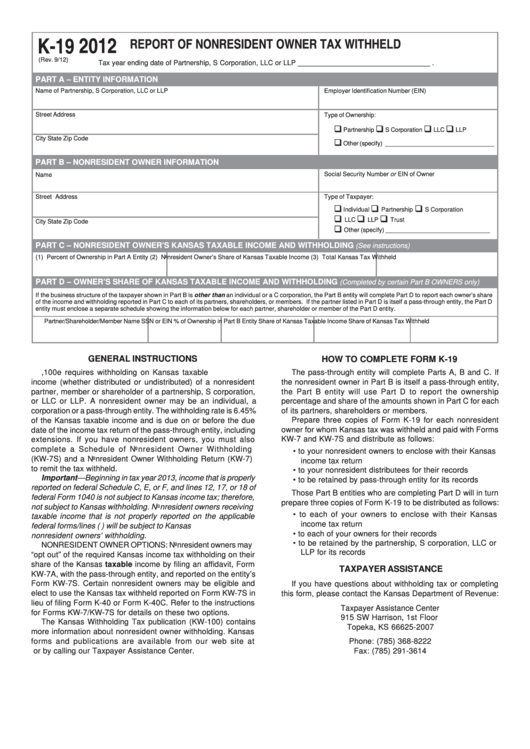

PART A – ENTITY INFORMATION

Name of Partnership, S Corporation, LLC or LLP

Employer Identification Number (EIN)

Street Address

Type of Ownership:

‰

‰

‰

‰

Partnership

S Corporation

LLC

LLP

City

State

Zip Code

‰

Other (specify) ________________________________

PART B – NONRESIDENT OWNER INFORMATION

Social Security Number or EIN of Owner

Name

Street Address

Type of Taxpayer:

‰

‰

‰

Individual

Partnership

S Corporation

‰

‰

‰

LLC

LLP

Trust

City

State

Zip Code

‰

Other (specify) ______________________________

PART C – NONRESIDENT OWNER’S KANSAS TAXABLE INCOME AND WITHHOLDING

(See instructions)

(1) Percent of Ownership in Part A Entity

(2) Nonresident Owner’s Share of Kansas Taxable Income

(3) Total Kansas Tax Withheld

PART D – OWNER’S SHARE OF KANSAS TAXABLE INCOME AND WITHHOLDING

(Completed by certain Part B OWNERS only)

If the business structure of the taxpayer shown in Part B is other than an individual or a C corporation, the Part B entity will complete Part D to report each owner’s share

of the income and withholding reported in Part C to each of its partners, shareholders, or members. If the partner listed in Part D is itself a pass-through entity, the Part D

entity must enclose a separate schedule showing the information below for each partner, shareholder or member of the Part D entity.

Partner/Shareholder/Member Name

SSN or EIN

% of Ownership in Part B Entity

Share of Kansas Taxable Income

Share of Kansas Tax Withheld

GENERAL INSTRUCTIONS

HOW TO COMPLETE FORM K-19

K.S.A. 79-32,100e requires withholding on Kansas taxable

The pass-through entity will complete Parts A, B and C. If

income (whether distributed or undistributed) of a nonresident

the nonresident owner in Part B is itself a pass-through entity,

partner, member or shareholder of a partnership, S corporation,

the Part B entity will use Part D to report the ownership

or LLC or LLP. A nonresident owner may be an individual, a

percentage and share of the amounts shown in Part C for each

corporation or a pass-through entity. The withholding rate is 6.45%

of its partners, shareholders or members.

of the Kansas taxable income and is due on or before the due

Prepare three copies of Form K-19 for each nonresident

date of the income tax return of the pass-through entity, including

owner for whom Kansas tax was withheld and paid with Forms

extensions. If you have nonresident owners, you must also

KW-7 and KW-7S and distribute as follows:

complete a Schedule of Nonresident Owner Withholding

• to your nonresident owners to enclose with their Kansas

(KW-7S) and a Nonresident Owner Withholding Return (KW-7)

income tax return

to remit the tax withheld.

• to your nonresident distributees for their records

Important—Beginning in tax year 2013, income that is properly

• to be retained by pass-through entity for its records

reported on federal Schedule C, E, or F, and lines 12, 17, or 18 of

Those Part B entities who are completing Part D will in turn

federal Form 1040 is not subject to Kansas income tax; therefore,

prepare three copies of Form K-19 to be distributed as follows:

not subject to Kansas withholding. Nonresident owners receiving

• to each of your owners to enclose with their Kansas

taxable income that is not properly reported on the applicable

income tax return

federal forms/lines (i.e. taxable income) will be subject to Kansas

• to each of your owners for their records

nonresident owners’ withholding.

• to be retained by the partnership, S corporation, LLC or

NONRESIDENT OWNER OPTIONS: Nonresident owners may

LLP for its records

“opt out” of the required Kansas income tax withholding on their

share of the Kansas taxable income by filing an affidavit, Form

TAXPAYER ASSISTANCE

KW-7A, with the pass-through entity, and reported on the entity’s

Form KW-7S. Certain nonresident owners may be eligible and

If you have questions about withholding tax or completing

elect to use the Kansas tax withheld reported on Form KW-7S in

this form, please contact the Kansas Department of Revenue:

lieu of filing Form K-40 or Form K-40C. Refer to the instructions

Taxpayer Assistance Center

for Forms KW-7/KW-7S for details on these two options.

915 SW Harrison, 1st Floor

The Kansas Withholding Tax publication (KW-100) contains

Topeka, KS 66625-2007

more information about nonresident owner withholding. Kansas

forms and publications are available from our web site at

Phone: (785) 368-8222

or by calling our Taxpayer Assistance Center.

Fax: (785) 291-3614

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1