Form Or-19 - Report Of Nonresident Owner Tax Withheld/tpv-19 - Payment Of Tax Withheld For Nonresidents

ADVERTISEMENT

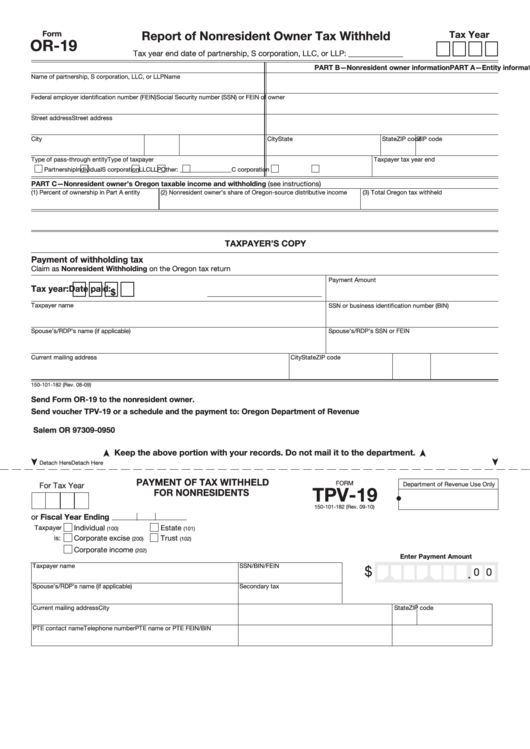

Report of Nonresident Owner Tax Withheld

Tax Year

Form

OR-19

Tax year end date of partnership, S corporation, LLC, or LLP: ______________

PART A—Entity information

PART B—Nonresident owner information

Name of partnership, S corporation, LLC, or LLP

Name

Federal employer identification number (FEIN)

Social Security number (SSN) or FEIN of owner

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Type of pass-through entity

Type of taxpayer

Taxpayer tax year end

Partnership

S corporation

LLC

LLP

Other: _________________

Individual

C corporation

PART C—Nonresident owner’s Oregon taxable income and withholding (see instructions)

(1) Percent of ownership in Part A entity

(2) Nonresident owner’s share of Oregon-source distributive income

(3) Total Oregon tax withheld

TAXPAYER’S COPY

Payment of withholding tax

Claim as Nonresident Withholding on the Oregon tax return

Payment Amount

Tax year:

Date paid:

$

Taxpayer name

SSN or business identification number (BIN)

Spouse’s/RDP’s name (if applicable)

Spouse’s/RDP’s SSN or FEIN

Current mailing address

City

State

ZIP code

150-101-182 (Rev. 08-09)

Send Form OR-19 to the nonresident owner.

Send voucher TPV-19 or a schedule and the payment to: Oregon Department of Revenue

P.O. Box 14950

Salem OR 97309-0950

Keep the above portion with your records. Do not mail it to the department.

Detach Here

Detach Here

PAYMENT OF TAX WITHHELD

FORM

For Tax Year

Department of Revenue Use Only

TPV-19

FOR NONRESIDENTS

•

150-101-182 (Rev. 09-10)

or Fiscal Year Ending

Taxpayer

Individual

Estate

(100)

(101)

Corporate excise

Trust

is:

(200)

(102)

Corporate income

(202)

Enter Payment Amount

Taxpayer name

SSN/BIN/FEIN

$

0 0

.

Spouse’s/RDP’s name (if applicable)

Secondary tax I.D. number

Current mailing address

City

State

ZIP code

PTE contact name

PTE name or PTE FEIN/BIN

Telephone number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1