Form 471 - Application For Deferment Of Summer Taxes July 1999

ADVERTISEMENT

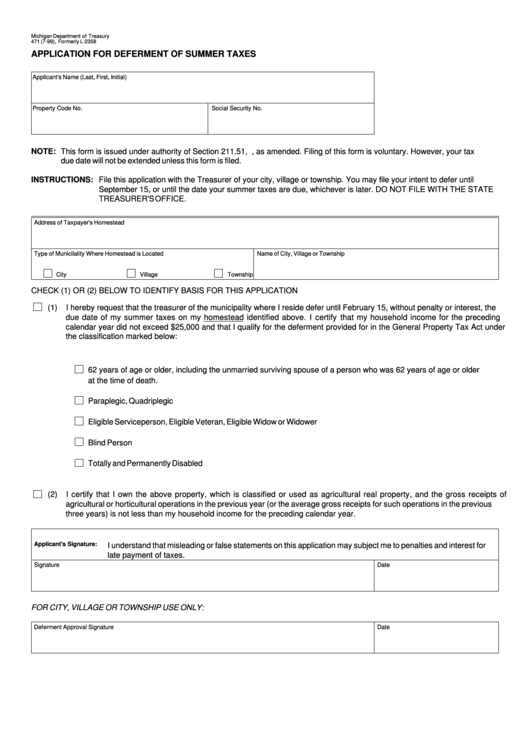

Michigan Department of Treasury

471 (7-99), Formerly L-2358

APPLICATION FOR DEFERMENT OF SUMMER TAXES

Applicant's Name (Last, First, Initial)

Property Code No.

Social Security No.

NOTE:

This form is issued under authority of Section 211.51, M.C.L., as amended. Filing of this form is voluntary. However, your tax

due date will not be extended unless this form is filed.

INSTRUCTIONS:

File this application with the Treasurer of your city, village or township. You may file your intent to defer until

September 15, or until the date your summer taxes are due, whichever is later. DO NOT FILE WITH THE STATE

TREASURER'S OFFICE.

Address of Taxpayer's Homestead

Type of Municilality Where Homestead is Located

Name of City, Village or Township

City

Village

Township

CHECK (1) OR (2) BELOW TO IDENTIFY BASIS FOR THIS APPLICATION

(1)

I hereby request that the treasurer of the municipality where I reside defer until February 15, without penalty or interest, the

due date of my summer taxes on my homestead identified above. I certify that my household income for the preceding

calendar year did not exceed $25,000 and that I qualify for the deferment provided for in the General Property Tax Act under

the classification marked below:

62 years of age or older, including the unmarried surviving spouse of a person who was 62 years of age or older

at the time of death.

Paraplegic, Quadriplegic

Eligible Serviceperson, Eligible Veteran, Eligible Widow or Widower

Blind Person

Totally and Permanently Disabled

(2)

I certify that I own the above property, which is classified or used as agricultural real property, and the gross receipts of

agricultural or horticultural operations in the previous year (or the average gross receipts for such operations in the previous

three years) is not less than my household income for the preceding calendar year.

Applicant's Signature:

I understand that misleading or false statements on this application may subject me to penalties and interest for

late payment of taxes.

Signature

Date

FOR CITY, VILLAGE OR TOWNSHIP USE ONLY:

Deferment Approval Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1