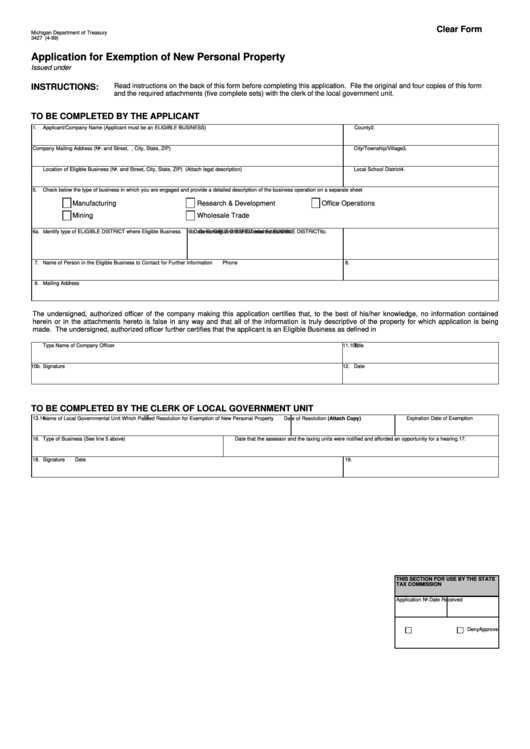

Clear Form

Michigan Department of Treasury

3427 (4-99)

Application for Exemption of New Personal Property

Issued under P.A. 328 of 1998. Filing is voluntary. An exemption will not be received until approved by the State Tax Commission.

Read instructions on the back of this form before completing this application. File the original and four copies of this form

INSTRUCTIONS:

and the required attachments (five complete sets) with the clerk of the local government unit.

TO BE COMPLETED BY THE APPLICANT

1.

Applicant/Company Name (Applicant must be an ELIGIBLE BUSINESS)

2.

County

Company Mailing Address (No. and Street, P.O. Box, City, State, ZIP)

3.

City/Township/Village

Location of Eligible Business (No. and Street, City, State, ZIP) (Attach legal description)

4.

Local School District

5.

Check below the type of business in which you are engaged and provide a detailed description of the business operation on a separate sheet

Manufacturing

Research & Development

Office Operations

Mining

Wholesale Trade

6a.

Identify type of ELIGIBLE DISTRICT where Eligible Business

6b.

Governing Unit that Established ELIGIBLE DISTRICT

6c.

Date ELIGIBLE DISTRICT was Established

7.

Name of Person in the Eligible Business to Contact for Further Information

8.

Phone

9.

Mailing Address

The undersigned, authorized officer of the company making this application certifies that, to the best of his/her knowledge, no information contained

herein or in the attachments hereto is false in any way and that all of the information is truly descriptive of the property for which application is being

made. The undersigned, authorized officer further certifies that the applicant is an Eligible Business as defined in P.A. 328 of 1998.

10a.

Type Name of Company Officer

11.

Title

10b.

Signature

12.

Date

TO BE COMPLETED BY THE CLERK OF LOCAL GOVERNMENT UNIT

15.

13.

Name of Local Governmental Unit Which Passed Resolution for Exemption of New Personal Property

14.

Date of Resolution (Attach Copy)

Expiration Date of Exemption

16.

Type of Business (See line 5 above)

17.

Date that the assessor and the taxing units were notified and afforded an opportunity for a hearing.

18.

Signature

19.

Date

THIS SECTION FOR USE BY THE STATE

TAX COMMISSION

Application No.

Date Received

Approve

Deny

1

1