1998

1998

66

66

1998

66

66

66

1998

1998

F

O

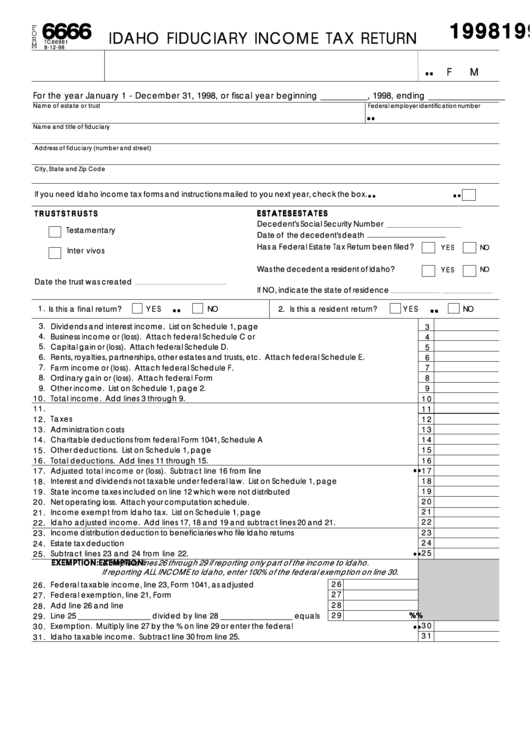

IDAHO FIDUCIARY INCOME TAX RETURN

R

TC66981

M

8-12-98

. . . . .

F

M

For the year January 1 - December 31, 1998, or fiscal year beginning ___________, 1998, ending __________________

Name of estate or trust

Federal employer identification number

. . . . .

Name and title of fiduciary

Address of fiduciary (number and street)

City, State and Zip Code

. . . . .

If you need Idaho income tax forms and instructions mailed to you next year, check the box.

T R U S T S

T R U S T S

E S T A T E S

E S T A T E S

E S T A T E S

E S T A T E S

E S T A T E S

T R U S T S

T R U S T S

T R U S T S

Decedent's Social Security Number

Testamentary

Date of the decedent's death

Has a Federal Estate Tax Return been filed?

Y E S

NO

Inter vivos

Was the decedent a resident of Idaho?

NO

Y E S

Date the trust was created

If NO, indicate the state of residence

. . . . .

. . . . .

1 .

Is this a final return?

Y E S

NO

2. Is this a resident return?

Y E S

NO

3.

Dividends and interest income. List on Schedule 1, page 2. ..................................................................

3

4.

Business income or (loss). Attach federal Schedule C or C-EZ. ..............................................................

4

5.

Capital gain or (loss). Attach federal Schedule D. ...................................................................................

5

6.

Rents, royalties, partnerships, other estates and trusts, etc. Attach federal Schedule E. ....................

6

7.

Farm income or (loss). Attach federal Schedule F. ..................................................................................

7

8.

Ordinary gain or (loss). Attach federal Form 4797. ................................................................................

8

9.

Other income. List on Schedule 1, page 2. ..............................................................................................

9

1 0 .

Total income. Add lines 3 through 9.

1 0

1 1 .

Interest .........................................................................................................................................................

1 1

Taxes ...........................................................................................................................................................

1 2 .

1 2

1 3 .

Administration costs ...................................................................................................................................

1 3

1 4 .

Charitable deductions from federal Form 1041, Schedule A ...................................................................

1 4

1 5 .

Other deductions. List on Schedule 1, page 2. ........................................................................................

1 5

Total deductions. Add lines 11 through 15.

1 6

1 6 .

. . . . .

1 7 .

Adjusted total income or (loss). Subtract line 16 from line 10. .............................................................

1 7

1 8 .

Interest and dividends not taxable under federal law. List on Schedule 1, page 2. ..............................

1 8

1 9 .

State income taxes included on line 12 which were not distributed .......................................................

1 9

Net operating loss. Attach your computation schedule. .........................................................................

2 0

2 0 .

2 1

2 1 .

Income exempt from Idaho tax. List on Schedule 1, page 2. .................................................................

2 2

2 2 .

Idaho adjusted income. Add lines 17, 18 and 19 and subtract lines 20 and 21.

2 3

2 3 .

Income distribution deduction to beneficiaries who file Idaho returns .....................................................

2 4

Estate tax deduction ...................................................................................................................................

2 4 .

. . . . .

2 5

Subtract lines 23 and 24 from line 22.

2 5 .

EXEMPTION:

EXEMPTION:

EXEMPTION: Complete lines 26 through 29 if reporting only part of the income to Idaho.

EXEMPTION:

EXEMPTION:

If reporting ALL INCOME to Idaho, enter 100% of the federal exemption on line 30.

2 6

Federal taxable income, line 23, Form 1041, as adjusted ..............................

2 6 .

2 7

Federal exemption, line 21, Form 1041 ...........................................................

2 7 .

2 8

Add line 26 and line 27. ...................................................................................

2 8 .

2 9

% % % % %

2 9 .

Line 25 __________________ divided by line 28 __________________ equals

. . . . .

3 0

Exemption. Multiply line 27 by the % on line 29 or enter the federal exemption. .................................

3 0 .

3 1

Idaho taxable income. Subtract line 30 from line 25.

3 1 .

1

1 2

2