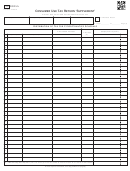

Form 14 - Consumer Use Tax Return Page 2

ADVERTISEMENT

ATTACH ADDITIONAL SHEETS IF NEEDED

SCHEDULE “C” - RETAIL DEALERS IN GASOLINE INFORMATION RETURN

Gallons of diesel

Gallons of

-Other-

Kerosene

name fuel &

purchased to be

purchased to be

report no. of gallons

retained for

Gallons of gasoline

Dollar Value of

Dollar Value of

Dollar Value

retained for

to be retained for

Name & Address of Supplier

and aircraft fuel

diesel purchased

Kerosene

of other

High-

High-

High-

High-

High-

Non

purchased

purchased

purchased

way

way

way

way

way

Highway

Use

Use

Use

Use

Use

Use

SCHEDULE “D” - SCHEDULE OF WHOLESALE SALES. WHOLESALE SALES ARE SALES FOR RESALE - ATTACH COPIES OF

INVOICES WHEN CLAIMING DEDUCTION.

Customer’s Retail

Total Amount Sold

Sales Account

Customer’s Name

Address

To Each Customer

Number

$

SCHEDULE “E” - SCHEDULE OF SALES TO CITY OF MOBILE DIRECT PAY PERMIT HOLDERS - ATTACH COPIES OF

INVOICES WHEN CLAIMING DEDUCTION.

City of Mobile

Direct Pay Permit

Name of Permit Holder

Address

Total Amount Sold

To Each Customer

Number

$

SCHEDULE “F” - OTHER ALLOWABLE DEDUCTIONS - EXPLAIN FULLY AND QUALIFY WITH COPIES OF INVOICES WHEN

CLAIMING DEDUCTION.

$

3.

SUMMARY OF DEDUCTIONS

Col. A

Col. B

Col. C

Col. D

(A) Taxable credit sales made during current month not collected

(B) Total wholesale sales (SALES FOR RESALE) both cash and credit - use SCHEDULE “D”

(C) Sales of lubricating oils and grease

(D) Sales of gasoline (RETAILER COMPLETE SCHEDULE “C” - DISTRIBUTORS COMPLETE

SCHEDULE A-1)

(E) Sales of fertilizer, seeds for planting purposes, baby chicks and poults

(F) Sales of foodstuffs for animal consumption - not including dog and cat food

(G) Sales to U.S. Gov., State of Alabama. Counties and incorporated cities and towns of Alabama

(H) Sales to firms holding a city of Mobile Direct Pay Permit _ must complete SCHEDULE “E” .

(I) Sales of prescription drugs

(J) Credit allowed for vehicles taken as part payment on sales - trade-ins

(K) OTHER ALLOWABLE DEDUCTIONS - (EXPLAIN FULLY ON SCHEDULE “F”)

4. TOTALS OF DEDUCTIONS - total of each column and enter on front

$

$

$

$

DEDUCTIONS NOT DOCUMENTED WILL BE DISALLOWED - - AMOUNT OWED PLUS PENALTY WILL BE ASSESSED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2