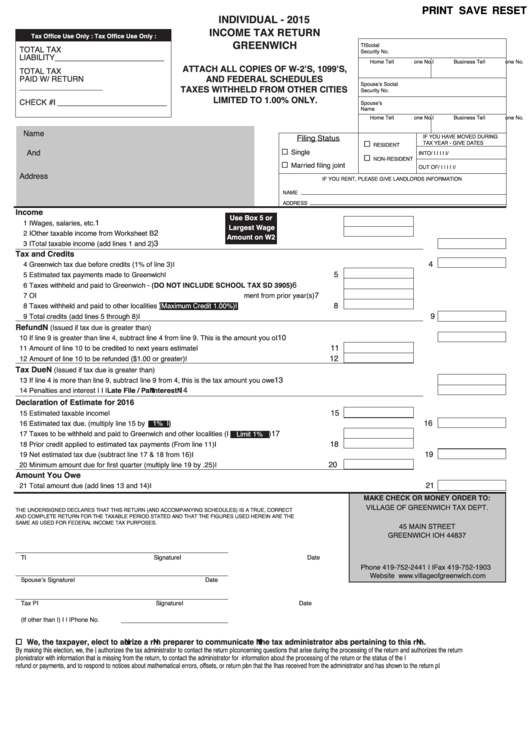

PRINT SAVE RESET

InDIvIDUAL - 2015

IncOmE TAx RETURn

Tax Office Use Only : Tax Office Use Only :

GREEnWIch

Taxpayer’s Social

ToTaL Tax

Security No.

LiaBiLiTy _________________________

home Telephone No.

Business Telephone No.

ATTAch ALL cOpIEs Of W-2’s, 1099’s,

ToTaL Tax

AnD fEDERAL schEDULEs

Paid w/ rETurN

Spouse’s Social

___________________

TAxEs WIThhELD fROm OThER cITIEs

Security No.

LImITED TO 1.00% OnLY.

chEck # _________________________

Spouse’s

Name

home Telephone No.

Business Telephone No.

Name

iF you haVE MoVEd duriNG

Filing Status

Tax yEar - GiVE daTES

rESidENT

and

Single

iNTo

/ /

NoN-rESidENT

Married filing joint

ouT oF

/ /

address

iF you rENT, PLEaSE GiVE LaNdLordS iNForMaTioN

NaME

addrESS

Income

Use Box 5 or

1

1 wages, salaries, etc.

Largest Wage

2

2 other taxable income from worksheet B

Amount on W2

3

3 Total taxable income (add lines 1 and 2)

Tax and credits

4

4 Greenwich tax due before credits (1% of line 3)

5

5 Estimated tax payments made to Greenwich

6

6 Taxes withheld and paid to Greenwich - (DO nOT IncLUDE schOOL TAx sD 3905)

7

7 overpayment from prior year(s)

8

8 Taxes withheld and paid to other localities

(Maximum credit 1.00%)

9

9 Total credits (add lines 5 through 8)

Refund

(issued if tax due is greater than)

10

10 if line 9 is greater than line 4, subtract line 4 from line 9. This is the amount you overpaid

11

11 amount of line 10 to be credited to next years estimate

12

12 amount of line 10 to be refunded ($1.00 or greater)

Tax Due

(issued if tax due is greater than)

13

13 if line 4 is more than line 9, subtract line 9 from 4, this is the tax amount you owe

14

14 Penalties and interest Late file / pay__________ Interest__________

Declaration of Estimate for 2016

15

15 Estimated taxable income

16

16 Estimated tax due. (multiply line 15 by

1%

)

17

17 Taxes to be withheld and paid to Greenwich and other localities (

)

Limit 1%

18

18 Prior credit applied to estimated tax payments (From line 11)

19

19 Net estimated tax due (subtract line 17 & 18 from 16)

20

20 Minimum amount due for first quarter (multiply line 19 by .25)

Amount You Owe

21

21 Total amount due (add lines 13 and 14)

mAkE chEck OR mOnEY ORDER TO:

ViLLaGE oF GrEENwich Tax dEPT.

ThE uNdErSiGNEd dEcLarES ThaT ThiS rETurN (aNd accoMPaNyiNG SchEduLES) iS a TruE, corrEcT

aNd coMPLETE rETurN For ThE TaxaBLE PEriod STaTEd aNd ThaT ThE FiGurES uSEd hErEiN arE ThE

SaME aS uSEd For FEdEraL iNcoME Tax PurPoSES.

45 MaiN STrEET

GrEENwich oh 44837

Taxpayer’s Signature

date

Phone 419-752-2441 Fax 419-752-1903

website

Spouse’s Signature

date

Tax Preparer’s Signature

date

(if other than taxpayer) Phone No.

We, the taxpayer, elect to authorize a return preparer to communicate with the tax administrator about matters pertaining to this return.

By making this election, we, the taxpayer, authorizes the tax administrator to contact the return preparer concerning questions that arise during the processing of the return and authorizes the return

preparer only to provide the administrator with information that is missing from the return, to contact the administrator for information about the processing of the return or the status of the taxpayer’s

.

refund or payments, and to respond to notices about mathematical errors, offsets, or return preparation that the taxpayer has received from the administrator and has shown to the return preparer

1

1 2

2 3

3 4

4