InDIvIDUAL GEnERAL InsTRUcTIOns

WhO mUsT fILE

REfUnDs

all residents of the Village of Greenwich, 18 years of age or

if any taxpayer has paid more tax than the Village is entitled

older, are required to file.

to, a refund of the overpayment will be made, provided a

a non-resident having income in the Village of Greenwich

proper claim for refund is filed. The net loss from an

from which city income tax has not been withheld and/or

unincorporated business may not be used to offset

who is engaged in a business or profession in Greenwich or

salaries, wages, commissions and other compensation.

owns rental property located in Greenwich.

amount under $1.00 will not be refunded.

all companies located in or doing business in Greenwich.

mIscELLAnEOUs

WhEn AnD WhERE TO fILE

1. Payments to the Village of under $1.00 do not have to be paid.

By april 18.

2. double check your credit on line 5 of the return by

Mail completed return with all w-2s, 1099 misc. forms, and

calling 419-752-2441.

federal schedules applicable to:

3. cafeteria plans are no longer village taxable.

GREEnWIch vILLAGE IncOmE TAx

4. contributions to 401ks, iras or other deferred plans are

45 mAIn sTREET, GREEnWIch, OhIO 44837

not deductible.

419-752-2441

5. SuB pay and sick pay are village taxable.

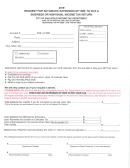

fILInG ExTEnsIOns

ExEmpT IncOmE (non inclusive)

Send a copy of your federal extension by april 18, and we

unemployment compensation (not including SuB pay).

will grant an extension of time not to exceed 6 weeks

Social Security

beyond the time granted by the irS. if we do not receive a

Payouts from pensions

copy of the extension you will be considered delinquent and

Military Pay (proof of military is required)

charged penalty and interest as shown on the return.

alimony

Extensions will not be granted, if your account is in any way

interest

delinquent.

dividends

nET LOssEs

ExEmpTIOn fOR TAxpAYERs

if a net loss has been incurred for the tax year a return must

if your income is solely from a non-taxable source, please

still be filed. Loss carry forwards are permitted.

contact our tax office for exemption form.

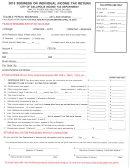

InsTRUcTIOns fOR IncOmE TAx RETURn

Married couples should file jointly. (whether or not you do so for your Federal or State returns)

Enter name and address and social security number(s) or Federal id No.

Taxpayer status - indicate how you are filing by marking one of the boxes.

residency - indicate if you live in the Village of Greenwich; also if you moved into or out of the village during the year.

Use Box 5 or

Line 1

Total wages (include sub pay, sick pay & deferred income) (From worksheet a)

Largest Wage

Line 2

other taxable income (From worksheet B)

Amount on W2

Line 3

Total Lines 1 & 2 - Losses on Line 2 - cannot offset losses on Line 1

Line 4

Greenwich income Tax 1%

Line 5

Estimated tax payments made to Greenwich

Line 6

Taxes withheld and paid to Greenwich (DO nOT IncLUDE schOOL TAx sD 3905)

Line 7

overpayment from prior years

Line 8

Taxes withheld and paid to other localities maximum credit 1.00%

Line 9

Total credits add lines 5 through 8

Line 10

amount overpaid

Line 11

amount of Line 10 credited to next year estimate

Line 12

amount to be refunded ($1.00 or greater)

Line 13

amount of tax owed

Line 14

Late File/Pay Penalties $25.00 per month, maximum $150.00, 5% per annum and additional 15% on any upaid balance.

DEcLARATIOn Of EsTImATE

nOTIcE

(Line 16 - 20) self-explanatory

TAx cREDIT

Line 21

Total amount due (add lines 13 and 14)

chAnGE

WORkshEET c - ExEmpTIOn (check correct boxes and return signed form)

sIGn fORm AnD ATTAch ALL W2s, 1099 mIsc AnD fEDERAL schEDULEs

PRINT SAVE RESET

1

1 2

2 3

3 4

4