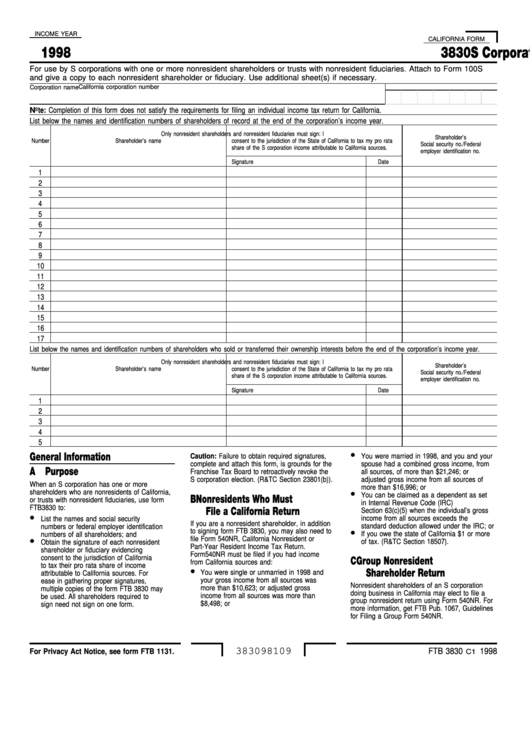

INCOME YEAR

CALIFORNIA FORM

1998

S Corporation’s List of Shareholders and Consents

3830

For use by S corporations with one or more nonresident shareholders or trusts with nonresident fiduciaries. Attach to Form 100S

and give a copy to each nonresident shareholder or fiduciary. Use additional sheet(s) if necessary.

California corporation number

Corporation name

Note: Completion of this form does not satisfy the requirements for filing an individual income tax return for California.

List below the names and identification numbers of shareholders of record at the end of the corporation’s income year.

Only nonresident shareholders and nonresident fiduciaries must sign: I

Shareholder’s

Number

Shareholder’s name

consent to the jurisdiction of the State of California to tax my pro rata

Social security no./Federal

share of the S corporation income attributable to California sources.

employer identification no.

Signature

Date

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

List below the names and identification numbers of shareholders who sold or transferred their ownership interests before the end of the corporation’s income year.

Only nonresident shareholders and nonresident fiduciaries must sign: I

Shareholder’s

Number

Shareholder’s name

consent to the jurisdiction of the State of California to tax my pro rata

Social security no./Federal

share of the S corporation income attributable to California sources.

employer identification no.

Signature

Date

1

2

3

4

5

•

General Information

Caution: Failure to obtain required signatures,

You were married in 1998, and you and your

complete and attach this form, is grounds for the

spouse had a combined gross income, from

A Purpose

Franchise Tax Board to retroactively revoke the

all sources, of more than $21,246; or

S corporation election. (R&TC Section 23801(b)).

adjusted gross income from all sources of

When an S corporation has one or more

more than $16,996; or

•

shareholders who are nonresidents of California,

You can be claimed as a dependent as set

B Nonresidents Who Must

or trusts with nonresident fiduciaries, use form

in Internal Revenue Code (IRC)

FTB 3830 to:

File a California Return

Section 63(c)(5) when the individual’s gross

•

income from all sources exceeds the

List the names and social security

If you are a nonresident shareholder, in addition

standard deduction allowed under the IRC; or

numbers or federal employer identification

•

to signing form FTB 3830, you may also need to

If you owe the state of California $1 or more

numbers of all shareholders; and

•

file Form 540NR, California Nonresident or

of tax. (R&TC Section 18507).

Obtain the signature of each nonresident

Part-Year Resident Income Tax Return.

shareholder or fiduciary evidencing

Form 540NR must be filed if you had income

consent to the jurisdiction of California

C Group Nonresident

from California sources and:

to tax their pro rata share of income

•

Shareholder Return

You were single or unmarried in 1998 and

attributable to California sources. For

your gross income from all sources was

ease in gathering proper signatures,

Nonresident shareholders of an S corporation

more than $10,623; or adjusted gross

multiple copies of the form FTB 3830 may

doing business in California may elect to file a

income from all sources was more than

be used. All shareholders required to

group nonresident return using Form 540NR. For

$8,498; or

sign need not sign on one form.

more information, get FTB Pub. 1067, Guidelines

for Filing a Group Form 540NR.

383098109

FTB 3830

1998

For Privacy Act Notice, see form FTB 1131.

C1

1

1