Affiliated Group Schedule Instructions

ADVERTISEMENT

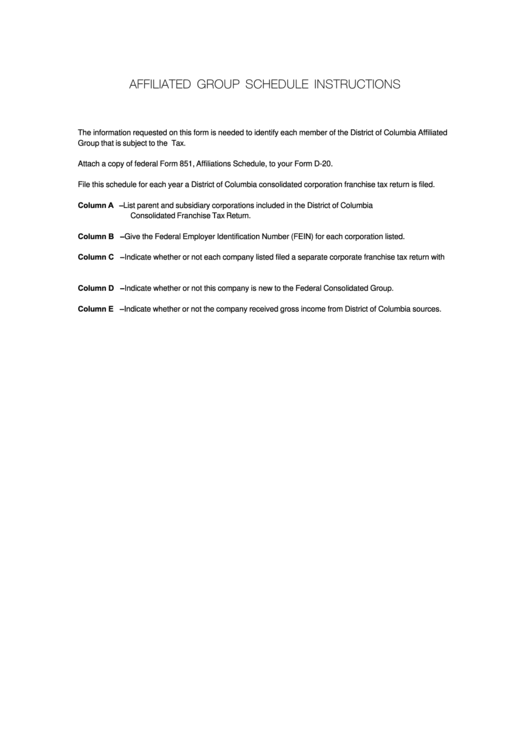

AFFILIATED GROUP SCHEDULE INSTRUCTIONS

The information requested on this form is needed to identify each member of the District of Columbia Affiliated

Group that is subject to the D.C. Corporation Franchise Tax.

Attach a copy of federal Form 851, Affiliations Schedule, to your Form D-20.

File this schedule for each year a District of Columbia consolidated corporation franchise tax return is filed.

Column A – List parent and subsidiary corporations included in the District of Columbia

Consolidated Franchise Tax Return.

Column B – Give the Federal Employer Identification Number (FEIN) for each corporation listed.

Column C – Indicate whether or not each company listed filed a separate corporate franchise tax return with

D.C. in the prior tax period.

Column D – Indicate whether or not this company is new to the Federal Consolidated Group.

Column E – Indicate whether or not the company received gross income from District of Columbia sources.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1