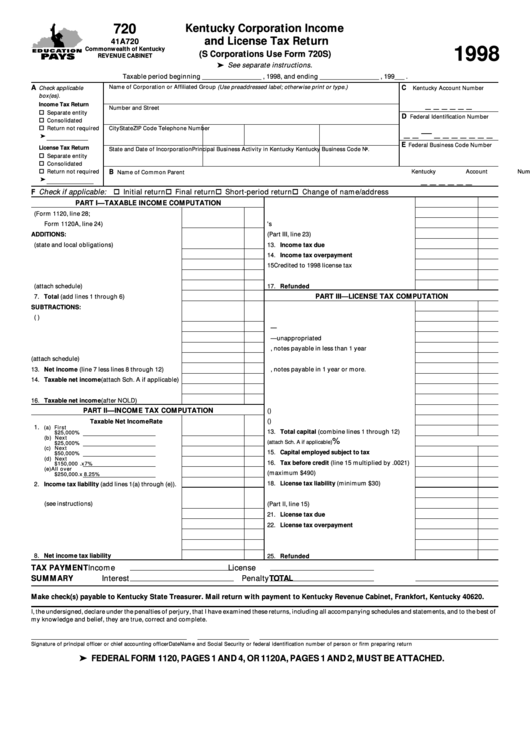

720

Kentucky Corporation Income

and License Tax Return

41A720

1998

Commonwealth of Kentucky

(S Corporations Use Form 720S)

REVENUE CABINET

ä

See separate instructions.

Taxable period beginning __________________ , 1998, and ending __________________ , 199___ .

A

Name of Corporation or Affiliated Group (Use preaddressed label; otherwise print or type.)

C

Check applicable

Kentucky Account Number

box(es).

_ _ _ _ _ _

Income Tax Return

Number and Street

Separate entity

D

Federal Identification Number

Consolidated

Return not required

City

State

ZIP Code

Telephone Number

_ _

_ _ _ _ _ _ _

—

E

Federal Business Code Number

License Tax Return

State and Date of Incorporation

Principal Business Activity in Kentucky

Kentucky Business Code No.

Separate entity

Consolidated

B

Return not required

Kentucky Account Number

Name of Common Parent

_ _ _ _ _ _

F Check if applicable:

Initial return

Final return

Short-period return

Change of name/address

PART I—TAXABLE INCOME COMPUTATION

9. Estimated payments .........................................

1. Federal taxable income (Form 1120, line 28;

10. Extension payment ...........................................

Form 1120A, line 24) ............................................

11. Prior year's credit .............................................

ADDITIONS:

12. License tax overpayment (Part III, line 23) ......

2. Interest income (state and local obligations) .....

13. Income tax due .................................................

3. State taxes based on net/gross income .............

14. Income tax overpayment .................................

4. Safe harbor lease adjustment .............................

15

Credited to 1998 license tax .............................

5. Deductions attributable to nontaxable income .

16. Claimed on 1999 estimate ................................

6. Other (attach schedule) .......................................

17. Refunded ..........................................................

PART III—LICENSE TAX COMPUTATION

7. Total (add lines 1 through 6) ..............................

SUBTRACTIONS:

1. Capital stock ......................................................

8. Interest income (U.S. obligations) ......................

2. Paid-in or capital surplus .................................

9. Dividend income ..................................................

3. Retained earnings—appropriated ...................

10. Federal work opportunity credit .........................

4. Retained earnings—unappropriated ...............

11. Safe harbor lease adjustment .............................

5. Mortgages, notes payable in less than 1 year

12. Other (attach schedule) .......................................

6. Advances by affiliated companies ...................

13. Net income (line 7 less lines 8 through 12) .......

7. Mortgages, notes payable in 1 year or more .

14. Taxable net income (attach Sch. A if applicable)

8. Other liabilities ..................................................

15. Net operating loss deduction .............................

9. Intercompany accounts ....................................

16. Taxable net income (after NOLD) .......................

10. Other capital accounts ......................................

PART II—INCOME TAX COMPUTATION

11. Less monies borrowed for inventory ..............

(

)

Taxable Net Income

Rate

12. Less KRS 136.071 deduction ............................

(

)

1.

(a) First

13. Total capital (combine lines 1 through 12) .....

$25,000 ....

x

4%

(b) Next

%

14. Apportionment fraction

(attach Sch. A if applicable)

$25,000 ....

x

5%

(c) Next

15. Capital employed subject to tax .......................

$50,000 ....

x

6%

(d) Next

16. Tax before credit (line 15 multiplied by .0021)

$150,000 .

x

7%

(e) All over

17. License tax credit (maximum $490) ................

$250,000 .

x 8.25%

18. License tax liability (minimum $30) ................

2. Income tax liability (add lines 1(a) through (e)) .

3. Economic development tax credits

19. Extension payment ...........................................

(see instructions) .................................................

20. Income tax overpayment (Part II, line 15) .......

4. Unemployment tax credit ...................................

21. License tax due .................................................

5. Recycling/composting equipment tax credit .....

22. License tax overpayment .................................

6. Coal conversion tax credit ..................................

23. Credited to 1998 income tax ............................

7. Enterprise zone tax credit ...................................

24. Credited to 1999 ................................................

8. Net income tax liability .......................................

25. Refunded ..........................................................

TAX PAYMENT

Income

License

SUMMARY

Interest

Penalty

TOTAL

Make check(s) payable to Kentucky State Treasurer. Mail return with payment to Kentucky Revenue Cabinet, Frankfort, Kentucky 40620.

I, the undersigned, declare under the penalties of perjury, that I have examined these returns, including all accompanying schedules and statements, and to the best of

my knowledge and belief, they are true, correct and complete.

Signature of principal officer or chief accounting officer

Date

Name and Social Security or federal identification number of person or firm preparing return

FEDERAL FORM 1120, PAGES 1 AND 4, OR 1120A, PAGES 1 AND 2, MUST BE ATTACHED.

1

1 2

2