Form Mf-007 - Licensed Alternate Fuels Dealer Or User Report - 2012

ADVERTISEMENT

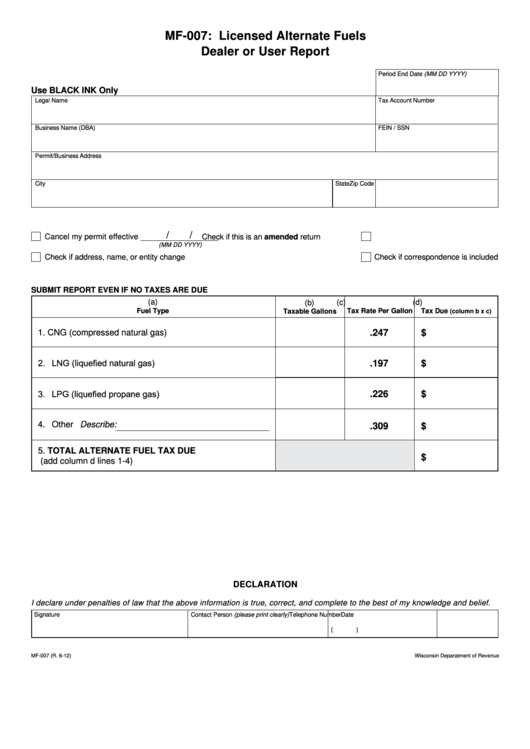

MF-007: Licensed Alternate Fuels

Dealer or User Report

Period End Date (MM DD YYYY)

Use BLACK INK Only

Legal Name

Tax Account Number

Business Name (DBA)

FEIN / SSN

Permit/Business Address

City

State

Zip Code

/

/

Cancel my permit effective

Check if this is an amended return

(MM DD YYYY)

Check if address, name, or entity change

Check if correspondence is included

SUBMIT REPORT EVEN IF NO TAXES ARE DUE

(a)

(c)

(d)

(b)

Fuel Type

Tax Rate Per Gallon

Tax Due

Taxable Gallons

(column b x c)

1. CNG (compressed natural gas)

.247

$

2. LNG (liquefied natural gas)

.197

$

3. LPG (liquefied propane gas)

.226

$

4. Other Describe:

.309

$

5. TOTAL ALTERNATE FUEL TAX DUE

$

(add column d lines 1-4)

DECLARATION

I declare under penalties of law that the above information is true, correct, and complete to the best of my knowledge and belief.

Signature

Contact Person (please print clearly)

Telephone Number

Date

(

)

Wisconsin Deparatment of Revenue

MF-007 (R. 6-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1