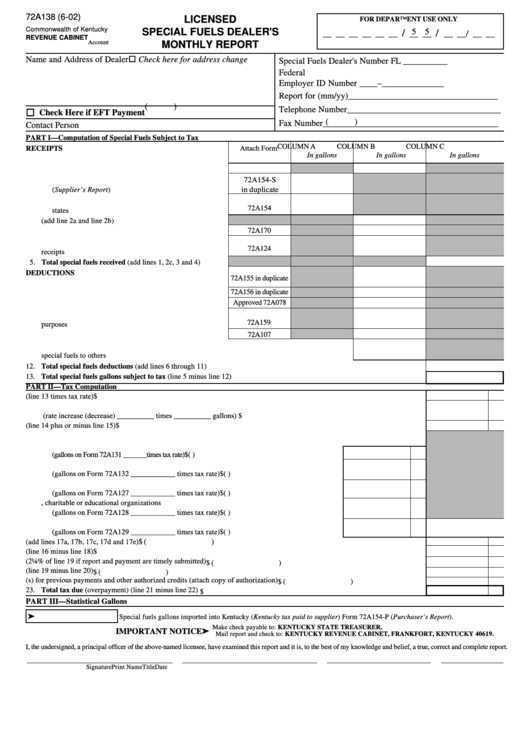

Form 72a138 - Licensed Special Fuels Dealer'S Monthly Report

ADVERTISEMENT

72A138 (6-02)

LICENSED

FOR DEPARTMENT USE ONLY

Commonwealth of Kentucky

SPECIAL FUELS DEALER'S

5 5

/

/

__ __ __ __ __ __

__ __

__ __ / __ __

REVENUE CABINET

Account Number

Tax

Mo.

Yr.

MONTHLY REPORT

o Check here for address change

Name and Address of Dealer

Special Fuels Dealer's Number FL __ __ __ __ __

Federal

Employer ID Number __ __ – __ __ __ __ __ __ __

Report for (mm/yy) __________________________________

(

)

o

Telephone Number ___________________________________

Check Here if EFT Payment

(

)

Fax Number ________________________________________

Contact Person

PART I—Computation of Special Fuels Subject to Tax

COLUMN A

COLUMN B

COLUMN C

RECEIPTS

Attach Form

In gallons

In gallons

In gallons

1. Special fuels purchased in Kentucky ......................................

72A153

2. a. Special fuels sold for import into Kentucky

72A154-S

(Supplier’s Report) .............................................................

in duplicate

b. Special fuels imported into Kentucky from other

72A154

states ....................................................................................

c. Total imports (add line 2a and line 2b) .............................

72A170

3. Taxable special fuels withdrawals from terminal storage ......

4. Kerosene blended with other special fuels and all other

72A124

receipts ......................................................................................

5. Total special fuels received (add lines 1, 2c, 3 and 4) .........

DEDUCTIONS

72A155 in duplicate

6. Special fuels exported from Kentucky ....................................

72A156 in duplicate

7. Special fuels sold to other Kentucky licensed dealers ...........

Approved 72A078

8. Special fuels lost through accountable losses .........................

9. Special fuels sold to railroad companies for nonhighway

72A159

purposes ....................................................................................

10. Special fuels sold to U.S. government ....................................

72A107

11. Special fuels used by licensed dealer for nonhighway purposes related to the distribution of

special fuels to others ..................................................................................................................................

12. Total special fuels deductions (add lines 6 through 11) ....................................................................................................................

13. Total special fuels gallons subject to tax (line 5 minus line 12) ......................................................................................................

PART II—Tax Computation

14. Gross tax liability (line 13 times tax rate) ............................................................................................................................................ $

15. Tax rate adjustment for special fuels gallons inventory held in wholesale bulk storage on the last day of each quarter

(rate increase (decrease) __________ times __________ gallons) .................................................................................................... $

16. Tax due after tax rate adjustment (line 14 plus or minus line 15) ....................................................................................................... $

17. Nonhighway dealer credits

a. Sales of special fuels for agricultural purposes

(gallons on Form 72A131 _______times tax rate) .................................................................................

$(

)

b. Sales of special fuels for residential heating purposes

(gallons on Form 72A132 ____________ times tax rate) ..............................................................

$(

)

c. Sales of special fuels to state or local government agencies

(gallons on Form 72A127 ____________ times tax rate) ..............................................................

$(

)

d. Sales of special fuels to nonprofit religious, charitable or educational organizations

(gallons on Form 72A128 ____________ times tax rate) ..............................................................

$(

)

e. Sales of special fuels for commercial use

(gallons on Form 72A129 ____________ times tax rate) ..............................................................

$(

)

$ (

)

18. Total nonhighway dealer credits (add lines 17a, 17b, 17c, 17d and 17e) ...........................................................................................

19. Tax due after credits (line 16 minus line 18) ........................................................................................................................................ $

20. Dealer compensation allowance (2¼% of line 19 if report and payment are timely submitted) ....................................................... $ (

)

21. Net tax due after allowable compensation (line 19 minus line 20) ..................................................................................................... $ (

)

22. Credit(s) for previous payments and other authorized credits (attach copy of authorization) ........................................................... $ (

)

23. Total tax due (overpayment) (line 21 minus line 22) ......................................................................................................................... $

PART III—Statistical Gallons

Special fuels gallons imported into Kentucky (Kentucky tax paid to supplier) Form 72A154-P (Purchaser’s Report).

Make check payable to: KENTUCKY STATE TREASURER.

IMPORTANT NOTICE

Mail report and check to: KENTUCKY REVENUE CABINET, FRANKFORT, KENTUCKY 40619.

I, the undersigned, a principal officer of the above-named licensee, have examined this report and it is, to the best of my knowledge and belief, a true, correct and complete report.

Signature

Print Name

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2