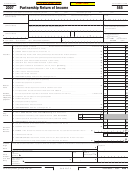

Form 565 - Partnership Return Of Income - 2012 Page 3

ADVERTISEMENT

Schedule K Partners’ Shares of Income, Deductions, Credits, etc.

(a)

(b)

(c)

(d)

Distributive share items

Amounts from

California

Total amounts using

federal K (1065)

adjustments

California law

I

1

. . . . . . . . . . . . . . . . . .

1

Ordinary income (loss) from trade or business activities

2

. . . . .

2

Net income (loss) from rental real estate activities. Attach federal Form 8825

3 a Gross income (loss) from other rental activities. . . . . . . . . . . . . . . . . . . .

3a

b Less expenses. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3b

I

c Net income (loss) from other rental activities. Subtract line 3b from line 3a

3c

I

4 Guaranteed payments to partners . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

I

5 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

I

6 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

I

7 Royalties

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

I

8 Net short-term capital gain (loss). Attach Schedule D (565) . . . . . . . . . . . . .

8

I

9 Net long-term capital gain (loss). Attach Schedule D (565). . . . . . . . . . . . . .

9

I

10 a Total Gain under IRC Section 1231

). . . 10a

(other than due to casualty or theft

I

b Total Loss under IRC Section 1231

. . . 10b

(other than due to casualty or theft)

11 a Other portfolio income (loss). Attach schedule . . . . . . . . . . . . . . . . . . . . 11a

b Total other income. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11b

c Total other loss. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11c

12 Expense deduction for recovery property (IRC Section 179 and R&TC

Sections 17267.2, 17267.6, and 17268). Attach schedule . . . . . . . . . . . . . . 12

13 a Charitable contributions. See instructions. Attach schedule. . . . . . . . . . . 13a

I

b Investment interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13b

c 1 Total expenditures to which IRC Section 59(e) election may apply. . . . . . .

13c1

2 Type of expenditures _________________________________________

13c2

d Deductions related to portfolio income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13d

e Other deductions. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13e

15 a Withholding on partnership allocated to all partners. . . . . . . . . . . . . . . . . . . .

15a

b Low-income housing credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15b

c Credits other than the credit shown on line 15b related to rental real

estate activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15c

d Credits related to other rental activities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15d

e Nonconsenting nonresident members’ tax allocated to all partners . . . . . . . .

15e

I

f

Other credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15f

g New Jobs Credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15g

17 a Depreciation adjustment on property placed in service after 1986 . . . . . . . . .

17a

b Adjusted gain or loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17b

c Depletion (other than oil and gas). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17c

d Gross income from oil, gas, and geothermal properties . . . . . . . . . . . . . . . . .

17d

e Deductions allocable to oil, gas, and geothermal properties . . . . . . . . . . . . . .

17e

f

Other alternative minimum tax items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17f

18 a Tax-exempt interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18a

I

b Other tax-exempt income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18b

c Nondeductible expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18c

19 a Distributions of money (cash and marketable securities) . . . . . . . . . . . . . . . .

19a

b Distribution of property other than money . . . . . . . . . . . . . . . . . . . . . . . . . . .

19b

20 a Investment income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20a

b Investment expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20b

c Other information. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20c

21 a

Total distributive income/payment items. Combine lines 1, 2, and 3c through 11c.

I

21a

From the result, subtract the sum of lines 12 through 13e. . . . . . . . . . . . . . . . . . .

b

Analysis by type

(a)

(b) Individual

(c)

(d)

(e)

of partner:

Corporate

i. Active

ii. Passive

Partnership

Exempt Organization

Nominee/Other

(1) General partners

(2) Limited partners

Form 565

2012 Side 3

3663123

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4