Form 8453n - Nebraska Individual Income Tax Declaration For Electronic Filing - 2000 Page 2

ADVERTISEMENT

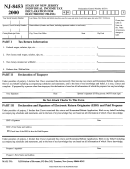

PART III – DECLARATION OF ELECTRONIC RETURN ORIGINATOR (ERO) AND PAID PREPARER

I declare that I have reviewed the above taxpayer’s return, and that the entries on this form are complete and correct to the best of my knowledge.

I have obtained the taxpayer’s signature on this form and provided the taxpayer with a copy of this form and all forms and information to be filed

with the Nebraska Department of Revenue. I have followed all other requirements described in Pub. Federal 1345, Handbook for Electronic Filers

of Individual Income Tax Returns (Tax Year 2000), and any requirements specified by the Nebraska Department of Revenue. If I am also the Paid

Preparer, under penalties of perjury, I declare that I have examined the above taxpayer’s return and accompanying schedules and statements,

and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer is based on all information of which preparer

has any knowledge.

sign

E

(

)

R

Date

Electronic Return Originator’s Signature

Telephone Number

here

O

Check if also Paid Preparer

Firm’s Name (or yours if self-employed)

Check if Self-Employed

Address

City

State

Zip Code

Electronic Filer Identification Number (EFIN)

Under penalties of perjury, I declare that I have examined the above taxpayer’s return and accompanying schedules and statements, and to the

P

best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer is based on all information of which the preparer has

A

any knowledge.

I

D

sign

(

)

here

Paid Preparer’s Signature

Telephone Number

Date

P

R

E

Firm’s Name (or yours if self-employed)

Check if Self-Employed

P

A

Address

City

State

Zip Code

R

E

R

ATTENTION ERO’S: DO NOT MAIL THIS FORM TO THE NEBRASKA DEPARTMENT OF REVENUE.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2