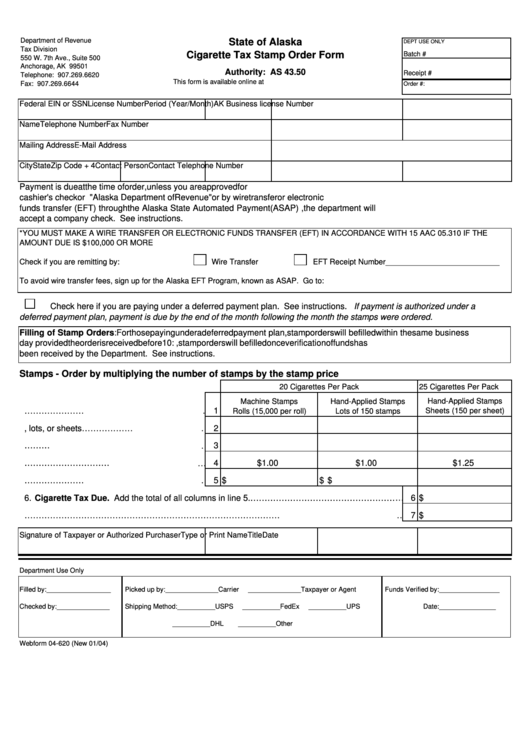

Form 04-620 - Cigarette Tax Stamp Order - 2004

ADVERTISEMENT

Department of Revenue

State of Alaska

DEPT USE ONLY

Tax Division

Cigarette Tax Stamp Order Form

Batch #

550 W. 7th Ave., Suite 500

Anchorage, AK 99501

Authority: AS 43.50

Receipt #

Telephone: 907.269.6620

This form is available online at

Fax: 907.269.6644

Order #:

Federal EIN or SSN

License Number

Period (Year/Month)

AK Business license Number

Name

Telephone Number

Fax Number

Mailing Address

E-Mail Address

City

State

Zip Code + 4

Contact Person

Contact Telephone Number

Payment is due at the time of order, unless you are approved for deferred payment. Payment must be in the form of a certified or

cashier's check or U.S. Postal money order made payable to the "Alaska Department of Revenue" or by wire transfer or electronic

funds transfer (EFT) through the Alaska State Automated Payment (ASAP) system. In special circumstances, the department will

accept a company check. See instructions.

*YOU MUST MAKE A WIRE TRANSFER OR ELECTRONIC FUNDS TRANSFER (EFT) IN ACCORDANCE WITH 15 AAC 05.310 IF THE

AMOUNT DUE IS $100,000 OR MORE

Check if you are remitting by:

Wire Transfer

EFT Receipt Number__________________________

To avoid wire transfer fees, sign up for the Alaska EFT Program, known as ASAP. Go to:

Check here if you are paying under a deferred payment plan. See instructions. If payment is authorized under a

deferred payment plan, payment is due by the end of the month following the month the stamps were ordered.

Filling of Stamp Orders: For those paying under a deferred payment plan, stamp orders will be filled within the same business

day provided the order is received before 10:00 a.m. AST. For all others, stamp orders will be filled once verification of funds has

been received by the Department. See instructions.

Stamps - Order by multiplying the number of stamps by the stamp price

20 Cigarettes Per Pack

25 Cigarettes Per Pack

Hand-Applied Stamps

Machine Stamps

Hand-Applied Stamps

1. Type and quantity of Stamps…………………… 1

Sheets (150 per sheet)

Rolls (15,000 per roll)

Lots of 150 stamps

2. Number of rolls, lots, or sheets………………… 2

3. Total stamps. Multiply line 1 by line 2………… 3

4. Value of each stamp…………………………… 4

$1.00

$1.00

$1.25

5. Tax. Multiply line 3 by line 4…………………… 5 $

$

$

6. Cigarette Tax Due. Add the total of all columns in line 5.……………………………………………… 6 $

7. Cigarette tax paid with order………………………………………………………………………………… 7 $

Signature of Taxpayer or Authorized Purchaser

Type or Print Name

Title

Date

Department Use Only

Filled by:_________________

Picked up by:______________Carrier

______________Taxpayer or Agent

Funds Verified by:________________

Checked by:______________

Shipping Method:__________USPS

__________FedEx

__________UPS

Date:_______________

__________DHL

__________Other

Webform 04-620 (New 01/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2