Tax Preparation Instructions - City Of Bowling Green

ADVERTISEMENT

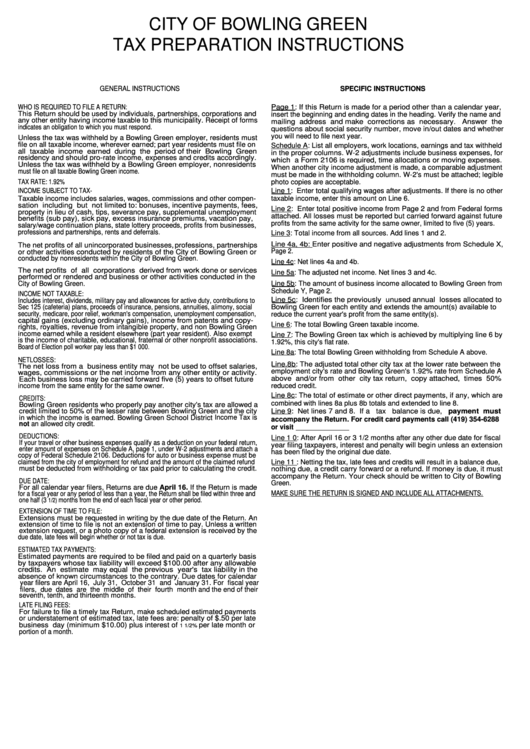

CITY OF BOWLING GREEN

TAX PREPARATION INSTRUCTIONS

GENERAL INSTRUCTIONS

SPECIFIC INSTRUCTIONS

WHO IS REQUIRED TO FILE A RETURN:

Page 1: If this Return is made for a period other than a calendar year,

This Return should be used by individuals, partnerships, corporations and

insert the beginning and ending dates in the heading. Verify the name and

any other entity having income taxable to this municipality. Receipt of forms

mailing address and make corrections as necessary. Answer the

indicates an obligation to which you must respond.

questions about social security number, move in/out dates and whether

you will need to file next year.

Unless the tax was withheld by a Bowling Green employer, residents must

file on all taxable income, wherever earned; part year residents must file on

Schedule A: List all employers, work locations, earnings and tax withheld

all taxable income earned during the period of their Bowling Green

in the proper columns. W-2 adjustments include business expenses, for

residency and should pro-rate income, expenses and credits accordingly.

which a Form 2106 is required, time allocations or moving expenses.

Unless the tax was withheld by a Bowling Green employer, nonresidents

When another city income adjustment is made, a comparable adjustment

must file on all taxable Bowling Green income.

must be made in the withholding column. W-2's must be attached; legible

TAX RATE: 1.92%

photo copies are acceptable.

INCOME SUBJECT TO TAX-

Line 1: Enter total qualifying wages after adjustments. If there is no other

Taxable income includes salaries, wages, commissions and other compen-

taxable income, enter this amount on Line 6.

sation including but not limited to: bonuses, incentive payments, fees,

Line 2: Enter total positive income from Page 2 and from Federal forms

property in lieu of cash, tips, severance pay, supplemental unemployment

attached. All losses must be reported but carried forward against future

benefits (sub pay), sick pay, excess insurance premiums, vacation pay,

profits from the same activity for the same owner, limited to five (5) years.

salary/wage continuation plans, state lottery proceeds, profits from businesses,

professions and partnerships, rents and deferrals.

Line 3: Total income from all sources. Add lines 1 and 2.

Line 4a, 4b: Enter positive and negative adjustments from Schedule X,

The net profits of all unincorporated businesses, professions, partnerships

Page 2.

or other activities conducted by residents of the City of Bowling Green or

conducted by nonresidents within the City of Bowling Green.

Line 4c: Net lines 4a and 4b.

The net profits of all corporations derived from work done or services

Line 5a: The adjusted net income. Net lines 3 and 4c.

performed or rendered and business or other activities conducted in the

City of Bowling Green.

Line 5b: The amount of business income allocated to Bowling Green from

Schedule Y, Page 2.

INCOME NOT TAXABLE:

Line 5c: Identifies the previously unused annual losses allocated to

Includes interest, dividends, military pay and allowances for active duty, contributions to

Sec 125 (cafeteria) plans, proceeds of insurance, pensions, annuities, alimony, social

Bowling Green for each entity and extends the amount(s) available to

security, medicare, poor relief, workman's compensation, unemployment compensation,

reduce the current year's profit from the same entity(s).

capital gains (excluding ordinary gains), income from patents and copy-

Line 6: The total Bowling Green taxable income.

rights, royalties, revenue from intangible property, and non Bowling Green

income earned while a resident elsewhere (part year resident). Also exempt

Line 7: The Bowling Green tax which is achieved by multiplying line 6 by

is the income of charitable, educational, fraternal or other nonprofit associations.

1.92%, this city's flat rate.

Board of Election poll worker pay less than $1 000.

Line 8a: The total Bowling Green withholding from Schedule A above.

NETLOSSES:

Line.8b: The adjusted total other city tax at the lower rate between the

The net loss from a business entity may not be used to offset salaries,

employment city's rate and Bowling Green's 1.92% rate from Schedule A

wages, commissions or the net income from any other entity or activity.

above and/or from other city tax return, copy attached, times 50%

Each business loss may be carried forward five (5) years to offset future

income from the same entity for the same owner.

reduced credit.

Line 8c: The total of estimate or other direct payments, if any, which are

CREDITS:

combined with lines 8a plus 8b totals and extended to line 8.

Bowling Green residents who properly pay another city's tax are allowed a

credit limited to 50% of the lesser rate between Bowling

Green and the city

Line 9: Net lines 7 and 8. If a tax balance is due, payment must

Income Tax is

in which the income is earned. Bowling Green School District

accompany the Return. For credit card payments call (419) 354-6288

not an allowed city credit.

or visit

DEDUCTIONS:

Line 1 0: After April 16 or 3 1/2 months after any other due date for fiscal

If your travel or other business expenses qualify as a deduction on your federal return,

year filing taxpayers, interest and penalty will begin unless an extension

enter amount of expenses on Schedule A, page 1, under W-2 adjustments and attach a

has been filed by the original due date.

copy of Federal Schedule 2106. Deductions for auto or business expense must be

claimed from the city of employment for refund and the amount of the claimed refund

Line 11 : Netting the tax, late fees and credits will result in a balance due,

must be deducted from withholding or tax paid prior to calculating the credit.

nothing due, a credit carry forward or a refund. If money is due, it must

accompany the Return. Your check should be written to City of Bowling

DUE DATE:

Green.

For all calendar year filers, Returns are due April 16. If the Return is made

MAKE SURE THE RETURN IS SIGNED AND INCLUDE ALL ATTACHMENTS.

for a fiscal year or any period of less than a year, the Return shall be filed within three and

one half (3

months from the end of each fiscal year or other period.

1/2)

EXTENSION OF TIME TO FILE:

Extensions must be requested in writing by the due date of the Return. An

extension of time to file is not an extension of time to pay. Unless a written

extension request, or a photo copy of a federal extension is received by the

due date, late fees will begin whether or not tax is due.

ESTIMATED TAX PAYMENTS:

Estimated payments are required to be filed and paid on a quarterly basis

by taxpayers whose tax liability will exceed $100.00 after any allowable

credits. An estimate may equal the previous year's tax liability in the

absence of known circumstances to the contrary. Due dates for calendar

year filers are April 16, July 31, October 31 and January 31. For fiscal year

filers, due dates are the middle of their fourth month and the end of their

seventh, tenth, and thirteenth months.

LATE FILING FEES:

For failure to file a timely tax Return, make scheduled estimated payments

or understatement of estimated tax, late fees are: penalty of $.50 per late

business day (minimum $10.00) plus interest of

per late month or

1 1/2%

portion of a month.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1