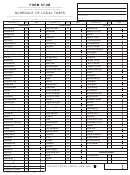

Form Vm-2b - Schedule Of Local Vending Machine Sales Tax

ADVERTISEMENT

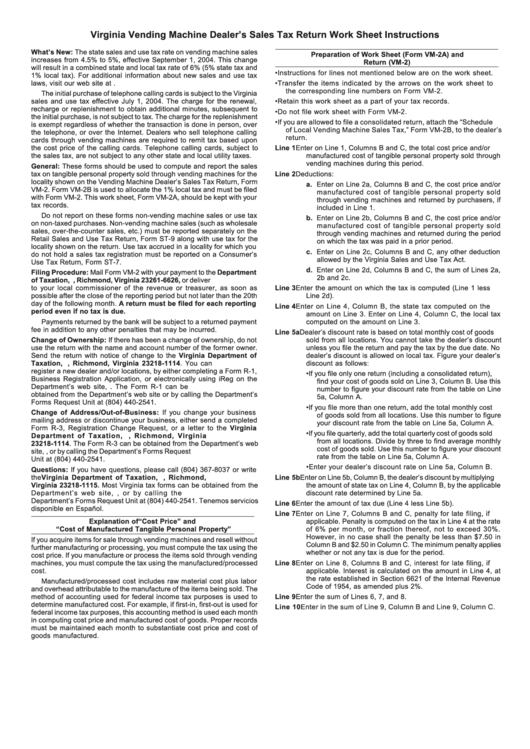

Virginia Vending Machine Dealer’s Sales Tax Return Work Sheet Instructions

What’s New: The state sales and use tax rate on vending machine sales

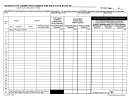

Preparation of Work Sheet (Form VM-2A) and

increases from 4.5% to 5%, effective September 1, 2004. This change

Return (VM-2)

will result in a combined state and local tax rate of 6% (5% state tax and

•

Instructions for lines not mentioned below are on the work sheet.

1% local tax). For additional information about new sales and use tax

laws, visit our web site at

•

Transfer the items indicated by the arrows on the work sheet to

the corresponding line numbers on Form VM-2.

The initial purchase of telephone calling cards is subject to the Virginia

sales and use tax effective July 1, 2004. The charge for the renewal,

•

Retain this work sheet as a part of your tax records.

recharge or replenishment to obtain additional minutes, subsequent to

•

Do not file work sheet with Form VM-2.

the initial purchase, is not subject to tax. The charge for the replenishment

•

If you are allowed to file a consolidated return, attach the “Schedule

is exempt regardless of whether the transaction is done in person, over

of Local Vending Machine Sales Tax,” Form VM-2B, to the dealer’s

the telephone, or over the Internet. Dealers who sell telephone calling

return.

cards through vending machines are required to remit tax based upon

the cost price of the calling cards. Telephone calling cards, subject to

Line 1

Enter on Line 1, Columns B and C, the total cost price and/or

the sales tax, are not subject to any other state and local utility taxes.

manufactured cost of tangible personal property sold through

vending machines during this period.

General: These forms should be used to compute and report the sales

tax on tangible personal property sold through vending machines for the

Line 2

Deductions:

locality shown on the Vending Machine Dealer’s Sales Tax Return, Form

a. Enter on Line 2a, Columns B and C, the cost price and/or

VM-2. Form VM-2B is used to allocate the 1% local tax and must be filed

manufactured cost of tangible personal property sold

with Form VM-2. This work sheet, Form VM-2A, should be kept with your

through vending machines and returned by purchasers, if

tax records.

included in Line 1.

Do not report on these forms non-vending machine sales or use tax

b. Enter on Line 2b, Columns B and C, the cost price and/or

on non-taxed purchases. Non-vending machine sales (such as wholesale

manufactured cost of tangible personal property sold

sales, over-the-counter sales, etc.) must be reported separately on the

through vending machines and returned during the period

Retail Sales and Use Tax Return, Form ST-9 along with use tax for the

on which the tax was paid in a prior period.

locality shown on the return. Use tax accrued in a locality for which you

c. Enter on Line 2c, Columns B and C, any other deduction

do not hold a sales tax registration must be reported on a Consumer’s

allowed by the Virginia Sales and Use Tax Act.

Use Tax Return, Form ST-7.

d. Enter on Line 2d, Columns B and C, the sum of Lines 2a,

Filing Procedure: Mail Form VM-2 with your payment to the Department

2b and 2c.

of Taxation, P.O. Box 26626, Richmond, Virginia 23261-6626, or deliver

to your local commissioner of the revenue or treasurer, as soon as

Line 3

Enter the amount on which the tax is computed (Line 1 less

possible after the close of the reporting period but not later than the 20th

Line 2d).

day of the following month. A return must be filed for each reporting

Line 4

Enter on Line 4, Column B, the state tax computed on the

period even if no tax is due.

amount on Line 3. Enter on Line 4, Column C, the local tax

Payments returned by the bank will be subject to a returned payment

computed on the amount on Line 3.

fee in addition to any other penalties that may be incurred.

Line 5a Dealer’s discount rate is based on total monthly cost of goods

Change of Ownership: If there has been a change of ownership, do not

sold from all locations. You cannot take the dealer’s discount

use the return with the name and account number of the former owner.

unless you file the return and pay the tax by the due date. No

Send the return with notice of change to the Virginia Department of

dealer’s discount is allowed on local tax. Figure your dealer’s

Taxation, P.O. Box 1114, Richmond, Virginia 23218-1114. You can

discount as follows:

register a new dealer and/or locations, by either completing a Form R-1,

•

If you file only one return (including a consolidated return),

Business Registration Application, or electronically using iReg on the

find your cost of goods sold on Line 3, Column B. Use this

Department’s web site, The Form R-1 can be

number to figure your discount rate from the table on Line

obtained from the Department’s web site or by calling the Department’s

5a, Column A.

Forms Request Unit at (804) 440-2541.

•

If you file more than one return, add the total monthly cost

Change of Address/Out-of-Business: If you change your business

of goods sold from all locations. Use this number to figure

mailing address or discontinue your business, either send a completed

your discount rate from the table on Line 5a, Column A.

Form R-3, Registration Change Request, or a letter to the Virginia

•

If you file quarterly, add the total quarterly cost of goods sold

Department of Taxation, P.O. Box 1114, Richmond, Virginia

from all locations. Divide by three to find average monthly

23218-1114. The Form R-3 can be obtained from the Department’s web

cost of goods sold. Use this number to figure your discount

site, , or by calling the Department’s Forms Request

rate from the table on Line 5a, Column A.

Unit at (804) 440-2541.

•

Enter your dealer’s discount rate on Line 5a, Column B.

Questions: If you have questions, please call (804) 367-8037 or write

the Virginia Department of Taxation, P.O. Box 1115, Richmond,

Line 5b Enter on Line 5b, Column B, the dealer’s discount by multiplying

Virginia 23218-1115. Most Virginia tax forms can be obtained from the

the amount of state tax on Line 4, Column B, by the applicable

Department’s web site, w w w.tax.state.va.us, or by calling the

discount rate determined by Line 5a.

Department’s Forms Request Unit at (804) 440-2541. Tenemos servicios

Line 6

Enter the amount of tax due (Line 4 less Line 5b).

disponible en Español.

Line 7

Enter on Line 7, Columns B and C, penalty for late filing, if

Explanation of “Cost Price” and

applicable. Penalty is computed on the tax in Line 4 at the rate

“Cost of Manufactured Tangible Personal Property”

of 6% per month, or fraction thereof, not to exceed 30%.

However, in no case shall the penalty be less than $7.50 in

If you acquire items for sale through vending machines and resell without

Column B and $2.50 in Column C. The minimum penalty applies

further manufacturing or processing, you must compute the tax using the

whether or not any tax is due for the period.

cost price. If you manufacture or process the items sold through vending

machines, you must compute the tax using the manufactured/processed

Line 8

Enter on Line 8, Columns B and C, interest for late filing, if

cost.

applicable. Interest is calculated on the amount in Line 4, at

the rate established in Section 6621 of the Internal Revenue

Manufactured/processed cost includes raw material cost plus labor

Code of 1954, as amended plus 2%.

and overhead attributable to the manufacture of the items being sold. The

method of accounting used for federal income tax purposes is used to

Line 9

Enter the sum of Lines 6, 7, and 8.

determine manufactured cost. For example, if first-in, first-out is used for

Line 10 Enter in the sum of Line 9, Column B and Line 9, Column C.

federal income tax purposes, this accounting method is used each month

in computing cost price and manufactured cost of goods. Proper records

must be maintained each month to substantiate cost price and cost of

goods manufactured.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3