Form Vm-2apc - Virginia Accelerated Vending Machine Sales Tax Payment Coupon

ADVERTISEMENT

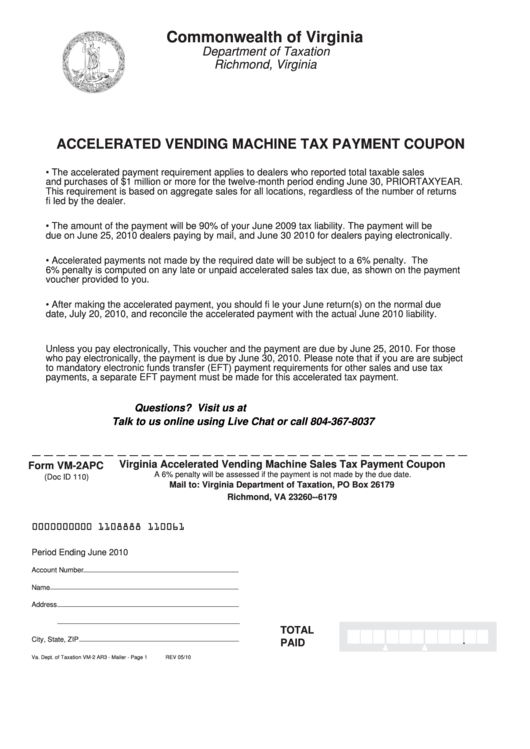

Commonwealth of Virginia

Department of Taxation

Richmond, Virginia

ACCELERATED VENDING MACHINE TAX PAYMENT COUPON

•

The accelerated payment requirement applies to dealers who reported total taxable sales

and purchases of $1 million or more for the twelve-month period ending June 30, PRIORTAXYEAR.

This requirement is based on aggregate sales for all locations, regardless of the number of returns

fi led by the dealer.

•

The amount of the payment will be 90% of your June 2009 tax liability. The payment will be

due on June 25, 2010 dealers paying by mail, and June 30 2010 for dealers paying electronically.

•

Accelerated payments not made by the required date will be subject to a 6% penalty. The

6% penalty is computed on any late or unpaid accelerated sales tax due, as shown on the payment

voucher provided to you.

•

After making the accelerated payment, you should fi le your June return(s) on the normal due

date, July 20, 2010, and reconcile the accelerated payment with the actual June 2010 liability.

Unless you pay electronically, This voucher and the payment are due by June 25, 2010. For those

who pay electronically, the payment is due by June 30, 2010. Please note that if you are are subject

to mandatory electronic funds transfer (EFT) payment requirements for other sales and use tax

payments, a separate EFT payment must be made for this accelerated tax payment.

Questions? Visit us at

Talk to us online using Live Chat or call 804-367-8037

Virginia Accelerated Vending Machine Sales Tax Payment Coupon

Form VM-2APC

A 6% penalty will be assessed if the payment is not made by the due date.

(Doc ID 110)

Mail to: Virginia Department of Taxation, PO Box 26179

Richmond, VA 23260--6179

0000000000 1108888 110061

Period Ending June 2010

Account Number

Name

Address

TOTAL

.

City, State, ZIP

PAID

Va. Dept. of Taxation VM-2 AR3 - Mailer - Page 1

REV 05/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1