Form 332 Draft - Credit For Healthy Forest Enterprises - 2010

ADVERTISEMENT

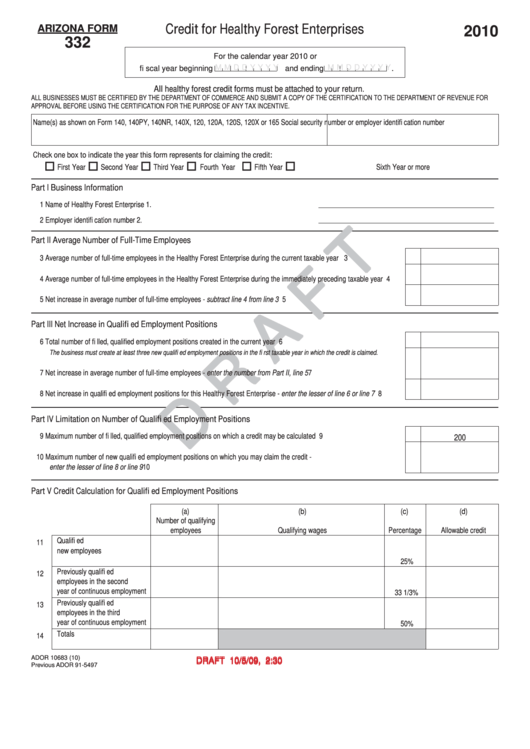

Credit for Healthy Forest Enterprises

ARIZONA FORM

2010

332

For the calendar year 2010 or

M M D D Y Y Y Y

M M D D Y Y Y Y

fi scal year beginning

and ending

.

All healthy forest credit forms must be attached to your return.

ALL BUSINESSES MUST BE CERTIFIED BY THE DEPARTMENT OF COMMERCE AND SUBMIT A COPY OF THE CERTIFICATION TO THE DEPARTMENT OF REVENUE FOR

APPROVAL BEFORE USING THE CERTIFICATION FOR THE PURPOSE OF ANY TAX INCENTIVE.

Name(s) as shown on Form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165

Social security number or employer identifi cation number

Check one box to indicate the year this form represents for claiming the credit:

First Year

Second Year

Third Year

Fourth Year

Fifth Year

Sixth Year or more

Part I

Business Information

1 Name of Healthy Forest Enterprise

1.

2 Employer identifi cation number

2.

Part II

Average Number of Full-Time Employees

3 Average number of full-time employees in the Healthy Forest Enterprise during the current taxable year ..............................

3

4 Average number of full-time employees in the Healthy Forest Enterprise during the immediately preceding taxable year .......

4

5 Net increase in average number of full-time employees - subtract line 4 from line 3 .................................................................

5

Part III

Net Increase in Qualifi ed Employment Positions

6 Total number of fi lled, qualifi ed employment positions created in the current year ....................................................................

6

The business must create at least three new qualifi ed employment positions in the fi rst taxable year in which the credit is claimed.

7 Net increase in average number of full-time employees - enter the number from Part II, line 5 ................................................

7

8 Net increase in qualifi ed employment positions for this Healthy Forest Enterprise - enter the lesser of line 6 or line 7 ............

8

Part IV Limitation on Number of Qualifi ed Employment Positions

9 Maximum number of fi lled, qualifi ed employment positions on which a credit may be calculated .............................................

9

200

10 Maximum number of new qualifi ed employment positions on which you may claim the credit -

enter the lesser of line 8 or line 9 ...............................................................................................................................................

10

Part V

Credit Calculation for Qualifi ed Employment Positions

(a)

(b)

(c)

(d)

Number of qualifying

employees

Qualifying wages

Percentage

Allowable credit

Qualifi ed

11

new employees

25%

Previously qualifi ed

12

employees in the second

year of continuous employment

33 1/3%

Previously qualifi ed

13

employees in the third

year of continuous employment

50%

Totals

14

ADOR 10683 (10)

DRAFT 10/5/09, 2:30 p.m.

DRAFT 10/5/09, 2:30 p.m.

Previous ADOR 91-5497

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5