Form 332 Instructions - Credits For Healthy Forest Enterprises - 2016

ADVERTISEMENT

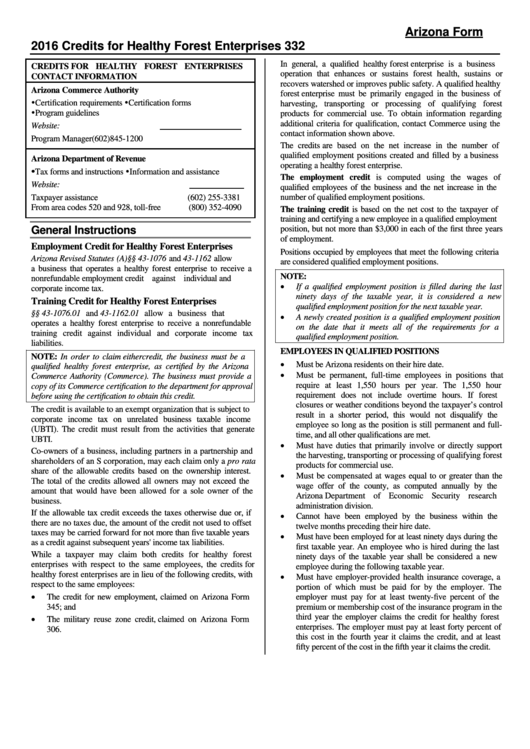

Arizona Form

2016 Credits for Healthy Forest Enterprises

332

In general, a qualified healthy forest enterprise is a business

CREDITS FOR HEALTHY FOREST ENTERPRISES

operation that enhances or sustains forest health, sustains or

CONTACT INFORMATION

recovers watershed or improves public safety. A qualified healthy

Arizona Commerce Authority

forest enterprise must be primarily engaged in the business of

Certification requirements Certification forms

harvesting, transporting or processing of qualifying forest

Program guidelines

products for commercial use. To obtain information regarding

additional criteria for qualification, contact Commerce using the

Website:

contact information shown above.

Program Manager

(602) 845-1200

The credits are based on the net increase in the number of

qualified employment positions created and filled by a business

Arizona Department of Revenue

operating a healthy forest enterprise.

Tax forms and instructions Information and assistance

The employment credit is computed using the wages of

Website:

qualified employees of the business and the net increase in the

number of qualified employment positions.

Taxpayer assistance

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

The training credit is based on the net cost to the taxpayer of

training and certifying a new employee in a qualified employment

position, but not more than $3,000 in each of the first three years

General Instructions

of employment.

Employment Credit for Healthy Forest Enterprises

Positions occupied by employees that meet the following criteria

Arizona Revised Statutes (A.R.S.) §§ 43-1076 and 43-1162 allow

are considered qualified employment positions.

a business that operates a healthy forest enterprise to receive a

NOTE:

nonrefundable employment credit against individual and

•

If a qualified employment position is filled during the last

corporate income tax.

ninety days of the taxable year, it is considered a new

Training Credit for Healthy Forest Enterprises

qualified employment position for the next taxable year.

A.R.S. §§ 43-1076.01 and 43-1162.01 allow a business that

•

A newly created position is a qualified employment position

operates a healthy forest enterprise to receive a nonrefundable

on the date that it meets all of the requirements for a

training credit against individual and corporate income tax

qualified employment position.

liabilities.

EMPLOYEES IN QUALIFIED POSITIONS

NOTE: In order to claim either credit, the business must be a

•

Must be Arizona residents on their hire date.

qualified healthy forest enterprise, as certified by the Arizona

•

Must be permanent, full-time employees in positions that

Commerce Authority (Commerce). The business must provide a

require at least 1,550 hours per year. The 1,550 hour

copy of its Commerce certification to the department for approval

requirement does not include overtime hours. If forest

before using the certification to obtain this credit.

closures or weather conditions beyond the taxpayer’s control

The credit is available to an exempt organization that is subject to

result in a shorter period, this would not disqualify the

corporate income tax on unrelated business taxable income

employee so long as the position is still permanent and full-

(UBTI). The credit must result from the activities that generate

time, and all other qualifications are met.

UBTI.

•

Must have duties that primarily involve or directly support

Co-owners of a business, including partners in a partnership and

the harvesting, transporting or processing of qualifying forest

shareholders of an S corporation, may each claim only a pro rata

products for commercial use.

share of the allowable credits based on the ownership interest.

•

Must be compensated at wages equal to or greater than the

The total of the credits allowed all owners may not exceed the

wage offer of the county, as computed annually by the

amount that would have been allowed for a sole owner of the

Arizona Department of Economic Security research

business.

administration division.

If the allowable tax credit exceeds the taxes otherwise due or, if

•

Cannot have been employed by the business within the

there are no taxes due, the amount of the credit not used to offset

twelve months preceding their hire date.

taxes may be carried forward for not more than five taxable years

•

Must have been employed for at least ninety days during the

as a credit against subsequent years' income tax liabilities.

first taxable year. An employee who is hired during the last

While a taxpayer may claim both credits for healthy forest

ninety days of the taxable year shall be considered a new

enterprises with respect to the same employees, the credits for

employee during the following taxable year.

healthy forest enterprises are in lieu of the following credits, with

•

Must have employer-provided health insurance coverage, a

respect to the same employees:

portion of which must be paid for by the employer. The

•

The credit for new employment, claimed on Arizona Form

employer must pay for at least twenty-five percent of the

345; and

premium or membership cost of the insurance program in the

•

third year the employer claims the credit for healthy forest

The military reuse zone credit, claimed on Arizona Form

enterprises. The employer must pay at least forty percent of

306.

this cost in the fourth year it claims the credit, and at least

fifty percent of the cost in the fifth year it claims the credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11