Clear Form

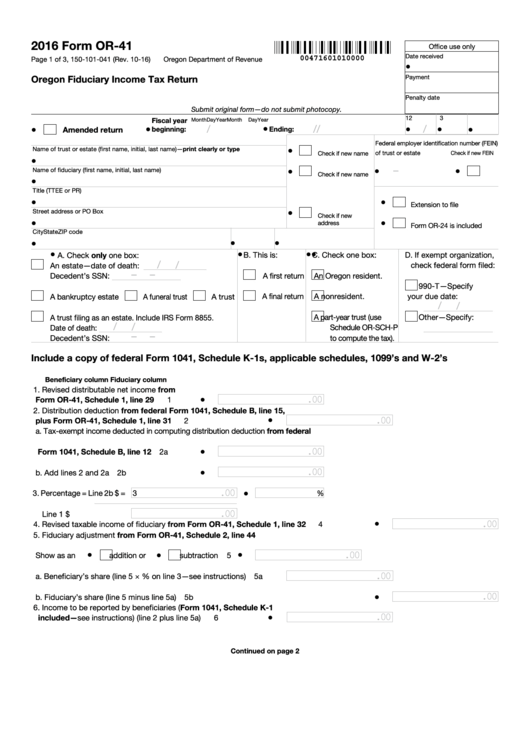

2016 Form OR-41

Office use only

Date received

00471601010000

Page 1 of 3, 150-101-041 (Rev. 10-16)

Oregon Department of Revenue

•

Oregon Fiduciary Income Tax Return

Payment

Penalty date

Submit original form—do not submit photocopy.

1

2

3

Fiscal year

Month

Day

Year

Month

Day

Year

/

/

•

/

/

•

•

•

•

•

Amended return

beginning:

Ending:

Federal employer identification number (FEIN)

Name of trust or estate (first name, initial, last name)—print clearly or type

•

of trust or estate

Check if new FEIN

Check if new name

•

–

•

•

•

Name of fiduciary (first name, initial, last name)

Check if new name

•

Title (TTEE or PR)

•

•

Extension to file

•

Street address or PO Box

Check if new

•

•

address

Form OR-24 is included

City

State

ZIP code

•

•

•

•

•

•

•

A. Check only one box:

B. This is:

C. Check one box:

D. If exempt organization,

/

/

check federal form filed:

An estate—date of death:

–

–

A first return

An Oregon resident.

Decedent’s SSN:

990-T—Specify

A final return

A nonresident.

your due date:

A bankruptcy estate

A funeral trust

A trust

/

/

A part-year trust (use

Other—Specify:

A trust filing as an estate. Include IRS Form 8855.

/

/

Schedule OR-SCH-P

Date of death:

–

–

to compute the tax).

Decedent’s SSN:

Include a copy of federal Form 1041, Schedule K-1s, applicable schedules, 1099’s and W-2’s

Beneficiary column

Fiduciary column

1. Revised distributable net income from

.00

•

Form OR-41, Schedule 1, line 29 ..............

1

2. Distribution deduction from federal Form 1041, Schedule B, line 15,

.00

•

plus Form OR-41, Schedule 1, line 31 .......................................

2

a. Tax-exempt income deducted in computing distribution deduction from federal

.00

•

Form 1041, Schedule B, line 12 .............

2a

.00

•

b. Add lines 2 and 2a ...................................

2b

.00

•

3. Percentage = Line 2b $

= 3

%

.00

Line 1

$

.00

•

4. Revised taxable income of fiduciary from Form OR-41, Schedule 1, line 32 ............................

4

5. Fiduciary adjustment from Form OR-41, Schedule 2, line 44

.00

•

•

•

Show as an

addition or

subtraction .....

5

.00

a. Beneficiary’s share (line 5 × % on line 3—see instructions) .... 5a

.00

•

b. Fiduciary’s share (line 5 minus line 5a) ....................................................................................

5b

6. Income to be reported by beneficiaries (Form 1041, Schedule K-1

.00

•

included—see instructions) (line 2 plus line 5a) ...........................

6

Continued on page 2

1

1 2

2 3

3