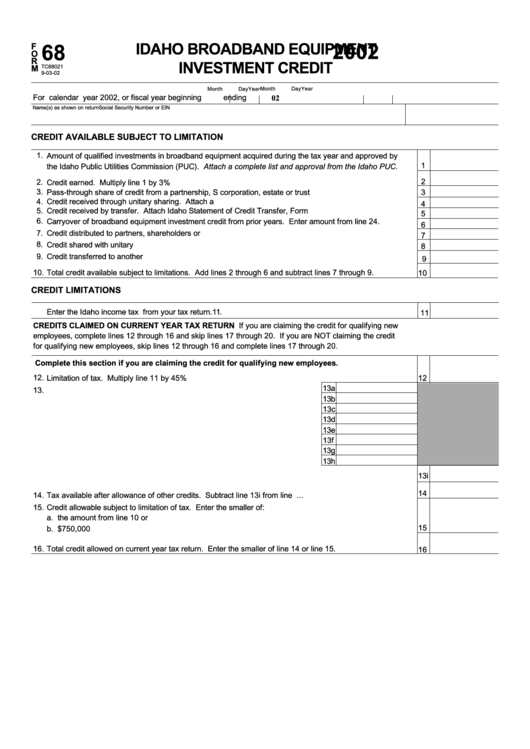

Form 68 - Idaho Broadband Equipment Investment Credit - 2002

ADVERTISEMENT

F

IDAHO BROADBAND EQUIPMENT

2002

68

O

R

INVESTMENT CREDIT

TC68021

M

9-03-02

Month

Day

Year

Month

Day

Year

For calendar year 2002, or fiscal year beginning

ending

02

Name(s) as shown on return

Social Security Number or EIN

CREDIT AVAILABLE SUBJECT TO LIMITATION

1.

Amount of qualified investments in broadband equipment acquired during the tax year and approved by

1

the Idaho Public Utilities Commission (PUC). Attach a complete list and approval from the Idaho PUC. .......

2

2.

Credit earned. Multiply line 1 by 3%. ..............................................................................................................

3.

Pass-through share of credit from a partnership, S corporation, estate or trust ...............................................

3

4.

Credit received through unitary sharing. Attach a schedule. ...........................................................................

4

5.

Credit received by transfer. Attach Idaho Statement of Credit Transfer, Form 70. ...........................................

5

6.

Carryover of broadband equipment investment credit from prior years. Enter amount from line 24. ...............

6

7.

Credit distributed to partners, shareholders or beneficiaries ............................................................................

7

8.

Credit shared with unitary affiliates ..................................................................................................................

8

9.

Credit transferred to another taxpayer .............................................................................................................

9

Total credit available subject to limitations. Add lines 2 through 6 and subtract lines 7 through 9.

10.

10

CREDIT LIMITATIONS

11.

Enter the Idaho income tax from your tax return.

11

CREDITS CLAIMED ON CURRENT YEAR TAX RETURN If you are claiming the credit for qualifying new

employees, complete lines 12 through 16 and skip lines 17 through 20. If you are NOT claiming the credit

for qualifying new employees, skip lines 12 through 16 and complete lines 17 through 20.

Complete this section if you are claiming the credit for qualifying new employees.

12.

Limitation of tax. Multiply line 11 by 45%. ........................................................................................................

12

13a

a. Credit for contributions to Idaho educational entities ....................................

13.

13b

b. Investment tax credit .....................................................................................

13c

c. Credit for contributions to Idaho youth and rehabilitation facilities .................

13d

d. Credit for production equipment using post-consumer waste .......................

13e

e. Natural resources conservation credit ..........................................................

13f

f. Promoter-sponsored event credit .................................................................

13g

g. Credit for qualifying new employees .............................................................

13h

h. Credit for Idaho research activities. ...............................................................

13i

i. Add lines 13a through 13h. ........................................................................................................................

14

14.

Tax available after allowance of other credits. Subtract line 13i from line 12. ..................................................

15.

Credit allowable subject to limitation of tax. Enter the smaller of:

a. the amount from line 10 or

15

b. $750,000 ...................................................................................................................................................

16.

Total credit allowed on current year tax return. Enter the smaller of line 14 or line 15.

16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2