STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

(Rev. 12/98)

FOR INCOME YEAR

Beginning

1998, and Ending

19

CT TAX REGISTRATION NUMBER

Corporation Name

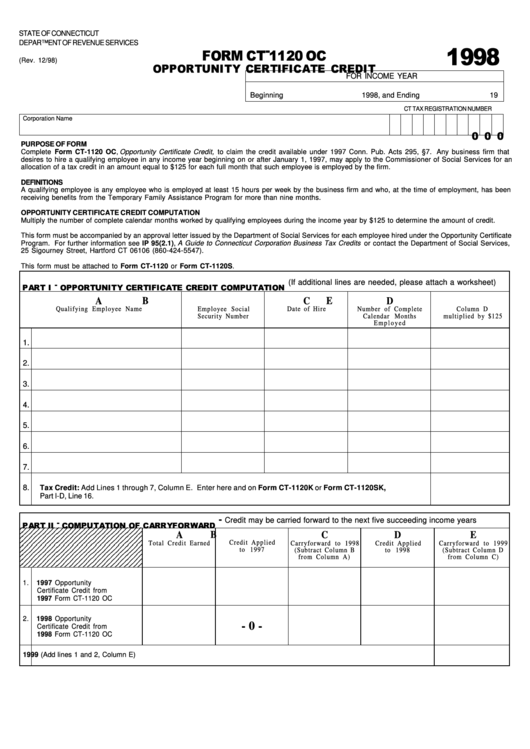

PURPOSE OF FORM

Complete Form CT-1120 OC, Opportunity Certificate Credit, to claim the credit available under 1997 Conn. Pub. Acts 295, §7. Any business firm that

desires to hire a qualifying employee in any income year beginning on or after January 1, 1997, may apply to the Commissioner of Social Services for an

allocation of a tax credit in an amount equal to $125 for each full month that such employee is employed by the firm.

DEFINITIONS

A qualifying employee is any employee who is employed at least 15 hours per week by the business firm and who, at the time of employment, has been

receiving benefits from the Temporary Family Assistance Program for more than nine months.

OPPORTUNITY CERTIFICATE CREDIT COMPUTATION

Multiply the number of complete calendar months worked by qualifying employees during the income year by $125 to determine the amount of credit.

This form must be accompanied by an approval letter issued by the Department of Social Services for each employee hired under the Opportunity Certificate

Program. For further information see IP 95(2.1), A Guide to Connecticut Corporation Business Tax Credits or contact the Department of Social Services,

25 Sigourney Street, Hartford CT 06106 (860-424-5547).

This form must be attached to Form CT-1120 or Form CT-1120S.

(If additional lines are needed, please attach a worksheet)

A

B

C

D

E

Qualifying Employee Name

Employee Social

Date of Hire

Number of Complete

Column D

Security Number

Calendar Months

multiplied by $125

E m p l o y e d

1.

2.

3.

4.

5.

6.

7.

8.

Tax Credit: Add Lines 1 through 7, Column E. Enter here and on Form CT-1120K or Form CT-1120SK,

Part I-D, Line 16.

-

Credit may be carried forward to the next five succeeding income years

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

A

B

C

D

E

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

Credit Applied

Total Credit Earned

Carryforward to 1998

Credit Applied

Carryforward to 1999

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

to 1997

(Subtract Column B

to 1998

(Subtract Column D

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

from Column A)

from Column C)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1.

1997 Opportunity

Certificate Credit from

1997 Form CT-1120 OC

2.

1998 Opportunity

- 0 -

Certificate Credit from

1998 Form CT-1120 OC

3. Total Opportunity Certificate Credit Carryforward to 1999 (Add lines 1 and 2, Column E)

1

1