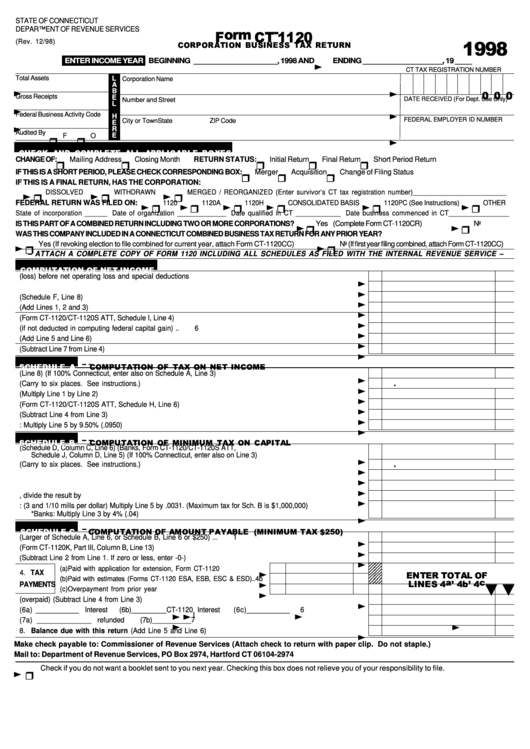

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

(Rev. 12/98)

ENTER INCOME YEAR

BEGINNING ____________________, 1998 AND

ENDING ___________________, 19 ____

CT TAX REGISTRATION NUMBER

Total Assets

L

Corporation Name

A

B

Gross Receipts

E

DATE RECEIVED (For Dept. Use Only)

Number and Street

L

Federal Business Activity Code

H

FEDERAL EMPLOYER ID NUMBER

City or Town

State

ZIP Code

E

R

Audited By

E

F

O

CHANGE OF:

Mailing Address

Closing Month

RETURN STATUS:

Initial Return

Final Return

Short Period Return

IF THIS IS A SHORT PERIOD, PLEASE CHECK CORRESPONDING BOX:

Merger

Acquisition

Change of Filing Status

IF THIS IS A FINAL RETURN, HAS THE CORPORATION:

DISSOLVED

WITHDRAWN

MERGED / REORGANIZED (Enter survivor’s CT tax registration number)_________________________

FEDERAL RETURN WAS FILED ON:

1120

1120A

1120H

CONSOLIDATED BASIS

1120PC (See Instructions)

OTHER

State of incorporation ______ Date of organization _____________ Date qualified in CT ____________ Date business commenced in CT________________

IS THIS PART OF A COMBINED RETURN INCLUDING TWO OR MORE CORPORATIONS?

Yes (Complete Form CT-1120CR)

No

WAS THIS COMPANY INCLUDED IN A CONNECTICUT COMBINED BUSINESS TAX RETURN FOR ANY PRIOR YEAR?

Yes (If revoking election to file combined for current year, attach Form CT-1120CC)

No (If first year filing combined, attach Form CT-1120CC)

– ATTACH A COMPLETE COPY OF FORM 1120 INCLUDING ALL SCHEDULES AS FILED WITH THE INTERNAL REVENUE SERVICE –

1. Federal taxable income (loss) before net operating loss and special deductions .........................................

1

2. Interest income wholly exempt from federal tax ..............................................................................................

2

3. Unallowable deduction for corporation tax (Schedule F, Line 8) ....................................................................

3

4. TOTAL (Add Lines 1, 2 and 3) .......................................................................................................................

4

5. Dividend deduction (Form CT-1120/CT-1120S ATT, Schedule I, Line 4) .........................................................

5

6. Capital loss carryover (if not deducted in computing federal capital gain) .....................................................

6

7. TOTAL (Add Line 5 and Line 6) ......................................................................................................................

7

8. NET INCOME (Subtract Line 7 from Line 4) ....................................................................................................

8

1. Net Income (Line 8) (If 100% Connecticut, enter also on Schedule A, Line 3) ...............................................

1

.

2. Apportionment fraction (Carry to six places. See instructions.) ....................................................................

2

0

3. Connecticut net income (Multiply Line 1 by Line 2) ..........................................................................................

3

4. Operating loss carryover (Form CT-1120/CT-1120S ATT, Schedule H, Line 6) .............................................

4

5. Income subject to tax (Subtract Line 4 from Line 3) ........................................................................................

5

6. TAX: Multiply Line 5 by 9.50% (.0950) .............................................................................................................

6

1. Minimum tax base (Schedule D, Column C, Line 6) (Banks, Form CT-1120/CT-1120S ATT,

Schedule J, Column D, Line 5) (If 100% Connecticut, enter also on Line 3) ...................................................

1

.

2. Apportionment fraction (Carry to six places. See instructions.) ....................................................................

2

0

3. Multiply Line 1 by Line 2 ....................................................................................................................................

3

4. Number of months covered by this return .......................................................................................................

4

5. Multiply Line 3 by Line 4, divide the result by 12 ..............................................................................................

5

6. TAX: (3 and 1/10 mills per dollar) Multiply Line 5 by .0031. (Maximum tax for Sch. B is $1,000,000)

*Banks: Multiply Line 3 by 4% (.04) ..................................................................................................................

6

1. Tax (Larger of Schedule A, Line 6, or Schedule B, Line 6 or $250) ...............................................................

1

2. Tax Credits (Form CT-1120K, Part III, Column B, Line 13) ................................................................................

2

3. Balance of tax payable (Subtract Line 2 from Line 1. If zero or less, enter -0-) ............................................

3

1 2 3 4 5 6

1 2 3 4 5 6

(a) Paid with application for extension, Form CT-1120 EXT ...........

4a

1 2 3 4 5 6

4. TAX

1 2 3 4 5 6

1 2 3 4 5 6

1 2 3 4 5 6

(b) Paid with estimates (Forms CT-1120 ESA, ESB, ESC & ESD) ..

4b

1 2 3 4 5 6

1 2 3 4 5 6

PAYMENTS

(c) Overpayment from prior year ......................................................

4 c

4

5. Balance of tax due (overpaid) (Subtract Line 4 from Line 3) ..........................................................................

5

6. Add Penalty

(6a) ___________

Interest

(6b) _________ CT-1120 Interest

(6c) ___________

6

7. Amount to be credited to 1999 estimated tax

(7a) ______________

refunded

(7b) __________

7

8. Balance due with this return (Add Line 5 and Line 6) ................................................................................

8

Make check payable to: Commissioner of Revenue Services (Attach check to return with paper clip. Do not staple.)

Mail to: Department of Revenue Services, PO Box 2974, Hartford CT 06104-2974

Check if you do not want a booklet sent to you next year. Checking this box does not relieve you of your responsibility to file.

1

1 2

2