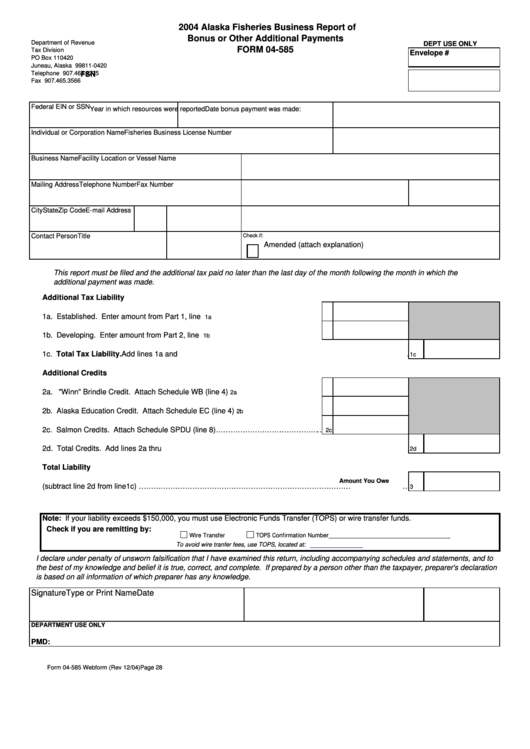

Form 04-585 - Alaska Fisheries Business Report Of Bonus Or Other Additional Payments - 2004

ADVERTISEMENT

2004 Alaska Fisheries Business Report of

Bonus or Other Additional Payments

Department of Revenue

DEPT USE ONLY

FORM 04-585

Tax Division

Envelope #

PO Box 110420

Juneau, Alaska 99811-0420

Telephone 907.465.3775

FSN

Fax 907.465.3566

Federal EIN or SSN

Year in which resources were reported

Date bonus payment was made:

Individual or Corporation Name

Fisheries Business License Number

Business Name

Facility Location or Vessel Name

Mailing Address

Telephone Number

Fax Number

City

State

Zip Code

E-mail Address

Contact Person

Title

Check if:

Amended (attach explanation)

This report must be filed and the additional tax paid no later than the last day of the month following the month in which the

additional payment was made.

Additional Tax Liability

1a. Established. Enter amount from Part 1, line 8.........................................................

1a

1b. Developing. Enter amount from Part 2, line 8.........................................................

1b

1c. Total Tax Liability. Add lines 1a and 1b...........................................................................................................

1c

Additional Credits

2a. A.W. "Winn" Brindle Credit. Attach Schedule WB (line 4).......................................

2a

2b. Alaska Education Credit. Attach Schedule EC (line 4)............................................

2b

2c. Salmon Credits. Attach Schedule SPDU (line 8)………………………………………

2c

2d. Total Credits. Add lines 2a thru 2c.....................................................................................................................

2d

Total Liability

Amount You Owe

3.Total Liability (subtract line 2d from line1c) ………………………………………………………………………………

3

Note: If your liability exceeds $150,000, you must use Electronic Funds Transfer (TOPS) or wire transfer funds.

Check if you are remitting by:

Wire Transfer

TOPS Confirmation Number______________________________________

To avoid wire tranfer fees, use TOPS, located at:

I declare under penalty of unsworn falsification that I have examined this return, including accompanying schedules and statements, and to

the best of my knowledge and belief it is true, correct, and complete. If prepared by a person other than the taxpayer, preparer's declaration

is based on all information of which preparer has any knowledge.

Signature

Type or Print Name

Date

DEPARTMENT USE ONLY

PMD:

Form 04-585 Webform (Rev 12/04)

Page 28

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2