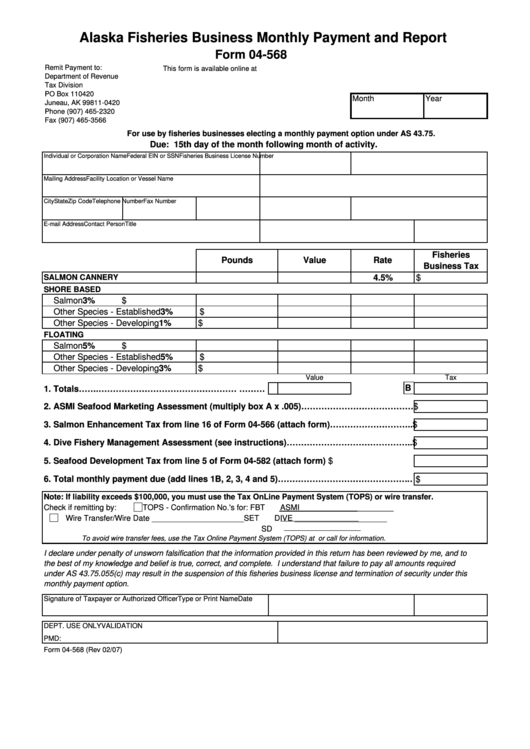

Alaska Fisheries Business Monthly Payment and Report

Form 04-568

Remit Payment to:

This form is available online at

Department of Revenue

Tax Division

PO Box 110420

Month

Year

Juneau, AK 99811-0420

Phone (907) 465-2320

Fax (907) 465-3566

For use by fisheries businesses electing a monthly payment option under AS 43.75.

Due: 15th day of the month following month of activity.

Individual or Corporation Name

Federal EIN or SSN

Fisheries Business License Number

Mailing Address

Facility Location or Vessel Name

City

State

Zip Code

Telephone Number

Fax Number

E-mail Address

Contact Person

Title

Fisheries

Pounds

Value

Rate

Business Tax

SALMON CANNERY

4.5%

$

SHORE BASED

Salmon

3%

$

Other Species - Established

3%

$

Other Species - Developing

1%

$

FLOATING

Salmon

$

5%

Other Species - Established

5%

$

Other Species - Developing

$

3%

Value

Tax

B

1. Totals…….…………………………………………............. A

………...........

2. ASMI Seafood Marketing Assessment (multiply box A x .005)………………………………… $

3. Salmon Enhancement Tax from line 16 of Form 04-566 (attach form)……………………….. $

4. Dive Fishery Management Assessment (see instructions)…………………………………….. $

5. Seafood Development Tax from line 5 of Form 04-582 (attach form).....................

$

6. Total monthly payment due (add lines 1B, 2, 3, 4 and 5)…………………………………………$

Note: If liability exceeds $100,000, you must use the Tax OnLine Payment System (TOPS) or wire transfer.

Check if remitting by:

TOPS - Confirmation No.'s for: FBT

ASMI _____________________

Wire Transfer/Wire Date _____________________

SET

DIVE _____________________

SD

To avoid wire transfer fees, use the Tax Online Payment System (TOPS) at

or call for information.

I declare under penalty of unsworn falsification that the information provided in this return has been reviewed by me, and to

the best of my knowledge and belief is true, correct, and complete. I understand that failure to pay all amounts required

under AS 43.75.055(c) may result in the suspension of this fisheries business license and termination of security under this

monthly payment option.

Signature of Taxpayer or Authorized Officer

Type or Print Name

Date

DEPT. USE ONLY

VALIDATION

PMD:

Form 04-568 (Rev 02/07)

1

1