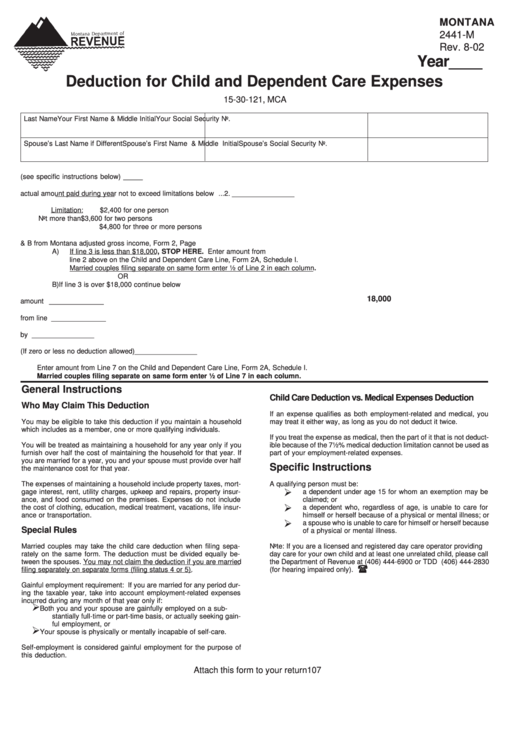

Montana Form 2441-M - Deduction For Child And Dependent Care Expenses - 2002

ADVERTISEMENT

MONTANA

2441-M

Rev. 8-02

Year____

Deduction for Child and Dependent Care Expenses

15-30-121, MCA

Last Name

Your First Name & Middle Initial

Your Social Security No.

Spouse’s Last Name if Different

Spouse’s First Name & Middle Initial

Spouse’s Social Security No.

1.

Number of qualifying persons cared for (see specific instructions below)........................................1. ________________

2.

Enter actual amount paid during year not to exceed limitations below ................................................................................... 2. ________________

Limitation:

$2,400 for one person

Not more than

$3,600 for two persons

$4,800 for three or more persons

3.

Combine amounts in columns A & B from Montana adjusted gross income, Form 2, Page 2 .....

3. _________________

A)

If line 3 is less than $18,000, STOP HERE. Enter amount from

line 2 above on the Child and Dependent Care Line, Form 2A, Schedule I.

Married couples filing separate on same form enter ½ of Line 2 in each column.

OR

B)

If line 3 is over $18,000 continue below

18,000

4.

Base wage amount ........................................................................................................................

4. _________________

5.

Subtract line 4 from line 3 ...............................................................................................................

5 ._________________

6.

Multiply line 5 by .50 ................................................................................................................................................................. 6. _________________

7.

Subtract line 6 from Line 2 (If zero or less no deduction allowed) ........................................................................................... 7. _________________

Enter amount from Line 7 on the Child and Dependent Care Line, Form 2A, Schedule I.

Married couples filing separate on same form enter ½ of Line 7 in each column.

General Instructions

Child Care Deduction vs. Medical Expenses Deduction

Who May Claim This Deduction

If an expense qualifies as both employment-related and medical, you

You may be eligible to take this deduction if you maintain a household

may treat it either way, as long as you do not deduct it twice.

which includes as a member, one or more qualifying individuals.

If you treat the expense as medical, then the part of it that is not deduct-

You will be treated as maintaining a household for any year only if you

ible because of the 7½% medical deduction limitation cannot be used as

furnish over half the cost of maintaining the household for that year. If

part of your employment-related expenses.

you are married for a year, you and your spouse must provide over half

Specific Instructions

the maintenance cost for that year.

The expenses of maintaining a household include property taxes, mort-

A qualifying person must be:

gage interest, rent, utility charges, upkeep and repairs, property insur-

a dependent under age 15 for whom an exemption may be

ance, and food consumed on the premises. Expenses do not include

claimed; or

the cost of clothing, education, medical treatment, vacations, life insur-

a dependent who, regardless of age, is unable to care for

ance or transportation.

himself or herself because of a physical or mental illness; or

a spouse who is unable to care for himself or herself because

Special Rules

of a physical or mental illness.

Married couples may take the child care deduction when filing sepa-

Note: If you are a licensed and registered day care operator providing

rately on the same form. The deduction must be divided equally be-

day care for your own child and at least one unrelated child, please call

tween the spouses. You may not claim the deduction if you are married

the Department of Revenue at (406) 444-6900 or TDD (406) 444-2830

filing separately on separate forms (filing status 4 or 5).

(for hearing impaired only).

Gainful employment requirement: If you are married for any period dur-

ing the taxable year, take into account employment-related expenses

incurred during any month of that year only if:

Both you and your spouse are gainfully employed on a sub-

stantially full-time or part-time basis, or actually seeking gain-

ful employment, or

Your spouse is physically or mentally incapable of self-care.

Self-employment is considered gainful employment for the purpose of

this deduction.

Attach this form to your return

107

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1