Commute Trip Reduction Credit Annual Application Form - 2012

ADVERTISEMENT

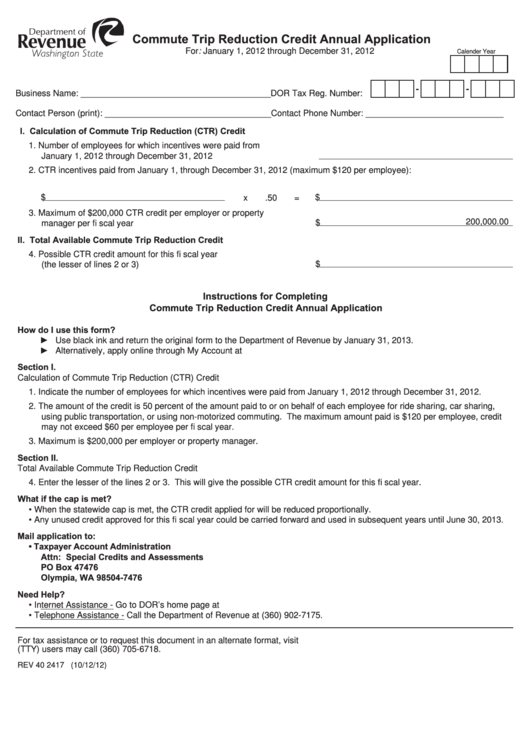

Commute Trip Reduction Credit Annual Application

For: January 1, 2012 through December 31, 2012

Calender Year

-

-

Business Name: ________________________________________DOR Tax Reg. Number:

Contact Person (print): ___________________________________Contact Phone Number: _____________________________

I. Calculation of Commute Trip Reduction (CTR) Credit

1. Number of employees for which incentives were paid from

January 1, 2012 through December 31, 2012

2. CTR incentives paid from January 1, through December 31, 2012 (maximum $120 per employee):

$

x

.50

=

$

3. Maximum of $200,000 CTR credit per employer or property

200,000.00

$

manager per fi scal year

II. Total Available Commute Trip Reduction Credit

4. Possible CTR credit amount for this fi scal year

$

(the lesser of lines 2 or 3)

Instructions for Completing

Commute Trip Reduction Credit Annual Application

How do I use this form?

► Use black ink and return the original form to the Department of Revenue by January 31, 2013.

► Alternatively, apply online through My Account at dor.wa.gov.

Section I.

Calculation of Commute Trip Reduction (CTR) Credit

1. Indicate the number of employees for which incentives were paid from January 1, 2012 through December 31, 2012.

2. The amount of the credit is 50 percent of the amount paid to or on behalf of each employee for ride sharing, car sharing,

using public transportation, or using non-motorized commuting. The maximum amount paid is $120 per employee, credit

may not exceed $60 per employee per fi scal year.

3. Maximum is $200,000 per employer or property manager.

Section II.

Total Available Commute Trip Reduction Credit

4. Enter the lesser of the lines 2 or 3. This will give the possible CTR credit amount for this fi scal year.

What if the cap is met?

•

When the statewide cap is met, the CTR credit applied for will be reduced proportionally.

•

Any unused credit approved for this fi scal year could be carried forward and used in subsequent years until June 30, 2013.

Mail application to:

•

Taxpayer Account Administration

Attn: Special Credits and Assessments

PO Box 47476

Olympia, WA 98504-7476

Need Help?

•

Internet Assistance - Go to DOR’s home page at dor.wa.gov

•

Telephone Assistance - Call the Department of Revenue at (360) 902-7175.

For tax assistance or to request this document in an alternate format, visit or call 1-800-647-7706. Teletype

(TTY) users may call (360) 705-6718.

REV 40 2417 (10/12/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1