Form Rev 40 2417 - Commute Trip Reduction Credit Annual Application Form - Department Of Revenue

ADVERTISEMENT

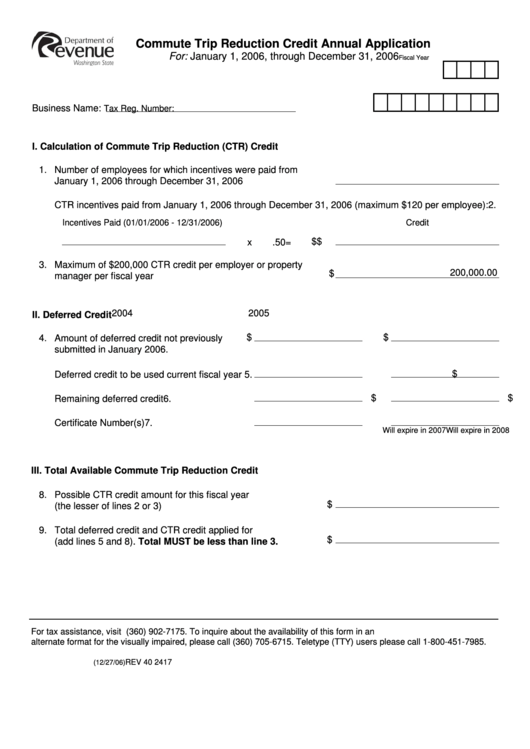

Commute Trip Reduction Credit Annual Application

For: January 1, 2006, through December 31, 2006

Fiscal Year

Business Name:

Tax Reg. Number:

I. Calculation of Commute Trip Reduction (CTR) Credit

1.

Number of employees for which incentives were paid from

January 1, 2006 through December 31, 2006

2.

CTR incentives paid from January 1, 2006 through December 31, 2006 (maximum $120 per employee):

Incentives Paid (01/01/2006 - 12/31/2006)

Credit

$

$

x

.50

=

3.

Maximum of $200,000 CTR credit per employer or property

200,000.00

$

manager per fiscal year

2004

2005

II. Deferred Credit

$

$

4.

Amount of deferred credit not previously

submitted in January 2006.

$

$

5.

Deferred credit to be used current fiscal year

$

$

6.

Remaining deferred credit

7.

Certificate Number(s)

Will expire in 2007

Will expire in 2008

III. Total Available Commute Trip Reduction Credit

8.

Possible CTR credit amount for this fiscal year

$

(the lesser of lines 2 or 3)

9.

Total deferred credit and CTR credit applied for

$

(add lines 5 and 8). Total MUST be less than line 3.

For tax assistance, visit or call (360) 902-7175. To inquire about the availability of this form in an

alternate format for the visually impaired, please call (360) 705-6715. Teletype (TTY) users please call 1-800-451-7985.

REV 40 2417

(12/27/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2