Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

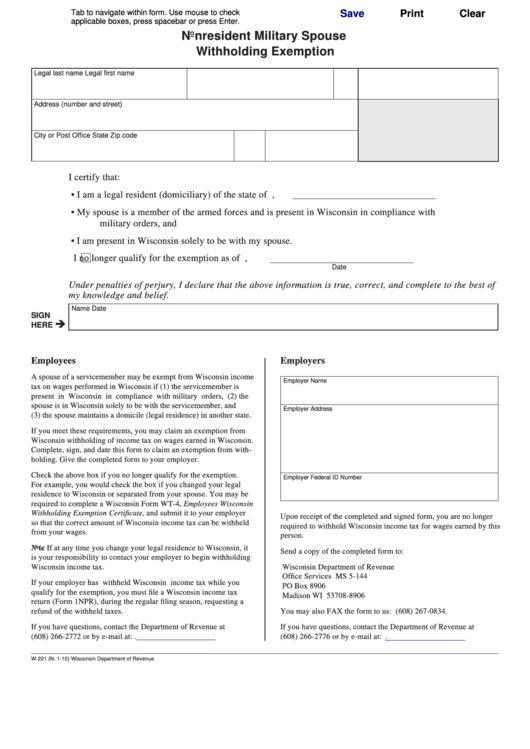

Nonresident Military Spouse

Withholding Exemption

Legal last name

Legal first name

M.I.

Social Security Number

Address (number and street)

City or Post Office

State

Zip code

I certify that:

• I am a legal resident (domiciliary) of the state of

,

• My spouse is a member of the armed forces and is present in Wisconsin in compliance with

military orders, and

• I am present in Wisconsin solely to be with my spouse.

I no longer qualify for the exemption as of

,

Date

Under penalties of perjury, I declare that the above information is true, correct, and complete to the best of

my knowledge and belief.

Name

Date

SIGN

HERE

Employees

Employers

A spouse of a servicemember may be exempt from Wisconsin income

Employer Name

tax on wages performed in Wisconsin if (1) the servicemember is

present in Wisconsin in compliance with military orders, (2) the

spouse is in Wisconsin solely to be with the servicemember, and

Employer Address

(3) the spouse maintains a domicile (legal residence) in another state.

If you meet these requirements, you may claim an exemption from

Wisconsin withholding of income tax on wages earned in Wisconsin.

Complete, sign, and date this form to claim an exemption from with‑

holding. Give the completed form to your employer.

Check the above box if you no longer qualify for the exemption.

Employer Federal ID Number

For example, you would check the box if you changed your legal

residence to Wisconsin or separated from your spouse. You may be

required to complete a Wisconsin Form WT‑4, Employees Wisconsin

Withholding Exemption Certificate, and submit it to your employer

Upon receipt of the completed and signed form, you are no longer

so that the correct amount of Wisconsin income tax can be withheld

required to withhold Wisconsin income tax for wages earned by this

from your wages.

person.

Note If at any time you change your legal residence to Wisconsin, it

Send a copy of the completed form to:

is your responsibility to contact your employer to begin withholding

Wisconsin income tax.

Wisconsin Department of Revenue

Office Services MS 5‑144

If your employer has withheld Wisconsin income tax while you

PO Box 8906

qualify for the exemption, you must file a Wisconsin income tax

Madison WI 53708‑8906

return (Form 1NPR), during the regular filing season, requesting a

refund of the withheld taxes.

You may also FAX the form to us: (608) 267‑0834.

If you have questions, contact the Department of Revenue at

If you have questions, contact the Department of Revenue at

(608) 266‑2772 or by e‑mail at: income@revenue.wi.gov.

(608) 266‑2776 or by e‑mail at: sales10@revenue.wi.gov.

W-221 (N. 1-10)

Wisconsin Department of Revenue

1

1