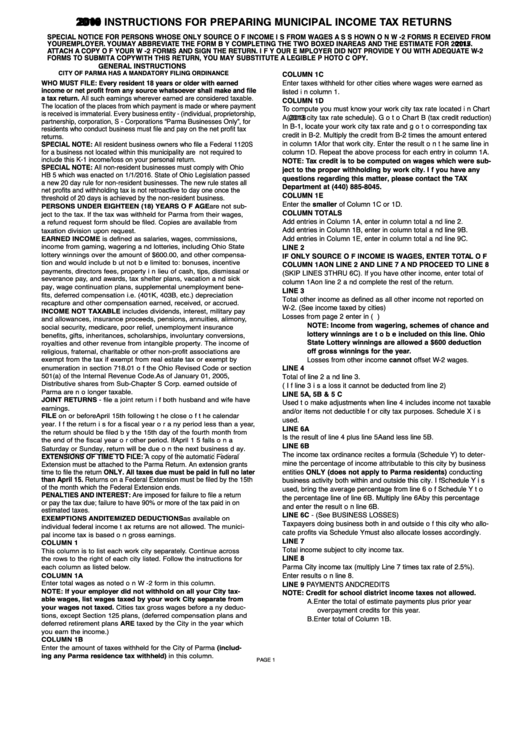

Instructions For Preparing Municipal Income Tax Returns - 2016

ADVERTISEMENT

2016

2017.

GENERAL INSTRUCTIONS

CITY OF PARMA HAS A MANDATORY FILING ORDINANCE

WHO MUST FILE: Every resident 18 years or older with earned

income or net profit from any source whatsoever shall make and file

a tax return. All such earnings wherever earned are considered taxable.

The location of the places from which payment is made or where payment

is received is immaterial. Every business entity - (individual, proprietorship,

(2016

partnership, corporation, S - Corporations “Parma Businesses Only”, for

residents who conduct business must file and pay on the net profit tax

returns.

SPECIAL NOTE: All resident business owners who file a Federal 1120S

for a business not located within this municipality are not required to

include this K-1 income/loss on your personal return.

SPECIAL NOTE: All non-resident businesses must comply with Ohio

HB 5 which was enacted on 1/1/2016. State of Ohio Legislation passed

a new 20 day rule for non-resident businesses. The new rule states all

net profits and withholding tax is not retroactive to day one once the

threshold of 20 days is achieved by the non-resident business.

EXTENSIONS OF TIME TO FILE: A copy of the automatic Federal

Extension must be attached to the Parma Return. An extension grants

time to file the return ONLY. All taxes due must be paid in full no later

than April 15. Returns on a Federal Extension must be filed by the 15th

of the month which the Federal Extension ends.

PENALTIES AND INTEREST: Are imposed for failure to file a return

or pay the tax due; failure to have 90% or more of the tax paid in on

estimated taxes.

PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4