Form Artx - Arts Tax Annual Household Exemption Form - 2013

ADVERTISEMENT

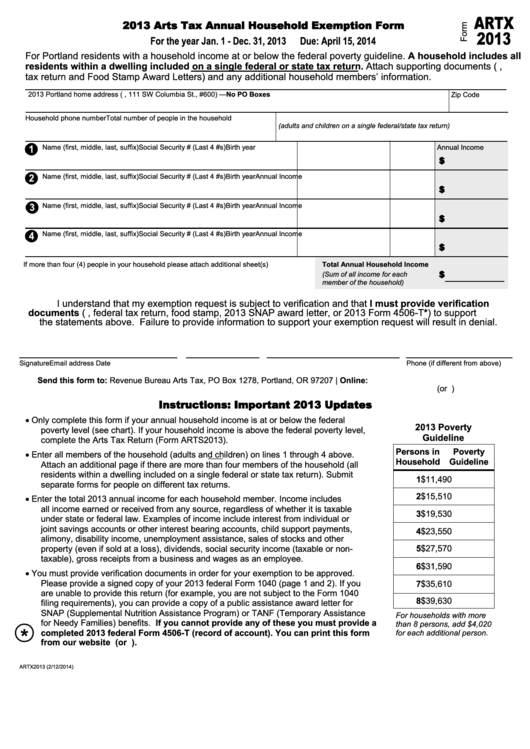

2013 Arts Tax Annual Household Exemption Form

For the year Jan. 1 - Dec. 31, 2013

Due: April 15, 2014

For Portland residents with a household income at or below the federal poverty guideline. A household includes all

residents within a dwelling included on a single federal or state tax return. Attach supporting documents (e.g.,

tax return and Food Stamp Award Letters) and any additional household members’ information.

2013 Portland home address (e.g., 111 SW Columbia St., #600) — No PO Boxes

Zip Code

Household phone number

Total number of people in the household

(adults and children on a single federal/state tax return)

Name (first, middle, last, suffix)

Social Security # (Last 4 #s) Birth year

Annual Income

$

Name (first, middle, last, suffix)

Social Security # (Last 4 #s) Birth year

Annual Income

$

Name (first, middle, last, suffix)

Social Security # (Last 4 #s) Birth year

Annual Income

$

Name (first, middle, last, suffix)

Social Security # (Last 4 #s) Birth year

Annual Income

$

If more than four (4) people in your household please attach additional sheet(s)

Total Annual Household Income

$

(Sum of all income for each

member of the household)

I understand that my exemption request is subject to verification and that I must provide verification

documents (e.g., federal tax return, food stamp, 2013 SNAP award letter, or 2013 Form 4506-T*) to support

the statements above. Failure to provide information to support your exemption request will result in denial.

Signature

Date

Email address

Phone (if different from above)

Send this form to: Revenue Bureau Arts Tax, PO Box 1278, Portland, OR 97207 | Online:

(or )

Instructions: Important 2013 Updates

Only complete this form if your annual household income is at or below the federal

2013 Poverty

poverty level (see chart). If your household income is above the federal poverty level,

Guideline

complete the Arts Tax Return (Form ARTS2013).

Persons in

Poverty

Enter all members of the household (adults and children) on lines 1 through 4 above.

Household

Guideline

Attach an additional page if there are more than four members of the household (all

residents within a dwelling included on a single federal or state tax return). Submit

1

$11,490

separate forms for people on different tax returns.

2

$15,510

Enter the total 2013 annual income for each household member. Income includes

all income earned or received from any source, regardless of whether it is taxable

3

$19,530

under state or federal law. Examples of income include interest from individual or

joint savings accounts or other interest bearing accounts, child support payments,

4

$23,550

alimony, disability income, unemployment assistance, sales of stocks and other

property (even if sold at a loss), dividends, social security income (taxable or non-

5

$27,570

taxable), gross receipts from a business and wages as an employee.

6

$31,590

You must provide verification documents in order for your exemption to be approved.

Please provide a signed copy of your 2013 federal Form 1040 (page 1 and 2). If you

7

$35,610

are unable to provide this return (for example, you are not subject to the Form 1040

8

$39,630

filing requirements), you can provide a copy of a public assistance award letter for

SNAP (Supplemental Nutrition Assistance Program) or TANF (Temporary Assistance

For households with more

for Needy Families) benefits. If you cannot provide any of these you must provide a

than 8 persons, add $4,020

*

completed 2013 federal Form 4506-T (record of account). You can print this form

for each additional person.

from our website (or ).

ARTX2013 (2/12/2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1