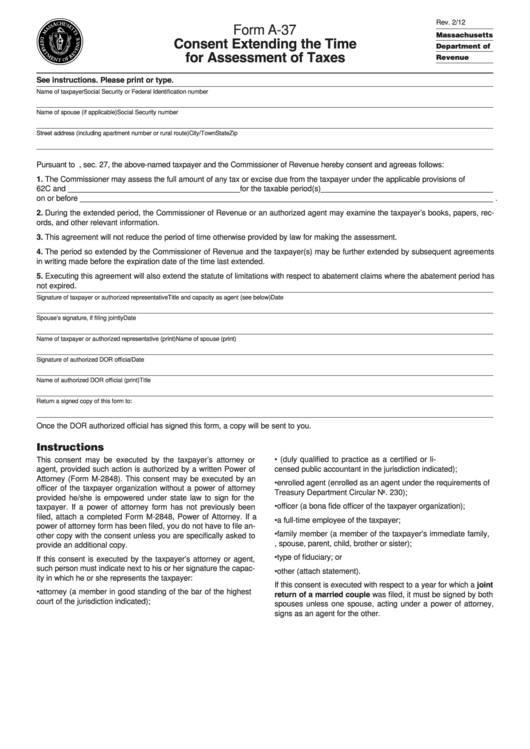

Form A-37 - Consent Extending The Time For Assessment Of Taxes

ADVERTISEMENT

Rev. 2/12

Form A-37

Massachusetts

Consent Extending the Time

Department of

for Assessment of Taxes

Revenue

See instructions. Please print or type.

Name of taxpayer

Social Security or Federal Identification number

Name of spouse (if applicable)

Social Security number

Street address (including apartment number or rural route)

City/Town

State

Zip

Pursuant to G.L. ch. 62C, sec. 27, the above-named taxpayer and the Commissioner of Revenue hereby consent and agree as follows:

1. The Commissioner may assess the full amount of any tax or excise due from the taxpayer under the applicable provisions of G.L. ch.

62C and ________________________________________ for the taxable period(s) ________________________________________

on or before ________________________________________________________________________________________________ .

2. During the extended period, the Commissioner of Revenue or an authorized agent may examine the taxpayer’s books, papers, rec-

ords, and other relevant information.

3. This agreement will not reduce the period of time otherwise provided by law for making the assessment.

4. The period so extended by the Commissioner of Revenue and the taxpayer(s) may be further extended by subsequent agreements

in writing made before the expiration date of the time last extended.

5. Executing this agreement will also extend the statute of limitations with respect to abatement claims where the abatement period has

not expired.

Signature of taxpayer or authorized representative

Title and capacity as agent (see below)

Date

Spouse’s signature, if filing jointly

Date

Name of taxpayer or authorized representative (print)

Name of spouse (print)

Signature of authorized DOR official

Date

Name of authorized DOR official (print)

Title

Return a signed copy of this form to:

Once the DOR authorized official has signed this form, a copy will be sent to you.

Instructions

This consent may be executed by the taxpayer’s attorney or

• C.P.A. or L.P.A. (duly qualified to practice as a certified or li-

agent, provided such action is authorized by a written Power of

censed public accountant in the jurisdiction indicated);

Attorney (Form M-2848). This consent may be executed by an

• enrolled agent (enrolled as an agent under the requirements of

officer of the taxpayer organization without a power of attorney

Treasury Department Circular No. 230);

provided he/she is empowered under state law to sign for the

• officer (a bona fide officer of the taxpayer organization);

taxpayer. If a power of attorney form has not previously been

filed, attach a completed Form M-2848, Power of Attorney. If a

• a full-time employee of the taxpayer;

power of attorney form has been filed, you do not have to file an-

• family member (a member of the taxpayer’s immediate family,

other copy with the consent unless you are specifically asked to

e.g., spouse, parent, child, brother or sister);

provide an additional copy.

• type of fiduciary; or

If this consent is executed by the taxpayer’s attorney or agent,

such person must indicate next to his or her signature the capac-

• other (attach statement).

ity in which he or she represents the taxpayer:

If this consent is executed with respect to a year for which a joint

• attorney (a member in good standing of the bar of the highest

return of a married couple was filed, it must be signed by both

court of the jurisdiction indicated);

spouses unless one spouse, acting under a power of attorney,

signs as an agent for the other.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1