Iowa Sales Tax Exemption Certificate Form

ADVERTISEMENT

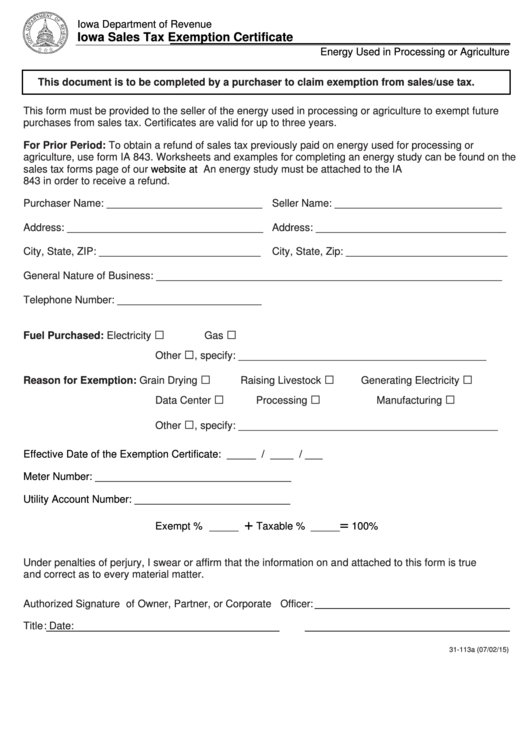

Iowa Department of Revenue

Iowa Sales Tax Exemption Certificate

https://tax.iowa.gov

Energy Used in Processing or Agriculture

This document is to be completed by a purchaser to claim exemption from sales/use tax.

This form must be provided to the seller of the energy used in processing or agriculture to exempt future

purchases from sales tax. Certificates are valid for up to three years.

For Prior Period: To obtain a refund of sales tax previously paid on energy used for processing or

agriculture, use form IA 843. Worksheets and examples for completing an energy study can be found on the

sales tax forms page of our

website at https://tax.iowa.gov.

An energy study must be attached to the IA

843 in order to receive a refund.

Purchaser Name: ___________________________

Seller Name: _____________________________

Address: __________________________________

Address: _________________________________

City, State, ZIP: ____________________________

City, State, Zip: ____________________________

General Nature of Business: ____________________________________________________________

Telephone Number: _________________________

□

□

Fuel Purchased:

Electricity

Gas

□

Other

, specify:

___________________________________________

□

□

□

Reason for Exemption:

Grain Drying

Raising Livestock

Generating Electricity

□

□

□

Data Center

Processing

Manufacturing

□

Other

, specify: _____________________________________________

Effective Date of the Exemption Certificate: _____ / ____ / ___

Meter Number: __________________________________

Utility Account Number: ___________________________

+

=

Exempt % _____

Taxable % _____

100%

Under penalties of perjury, I swear or affirm that the information on and attached to this form is true

and correct as to every material matter.

Authorized Signature of Owner, Partner, or Corporate Officer:

Title:

Date:

31-113a (07/02/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1