Form 74a117a - Insurance Surcharge Report - 2012

ADVERTISEMENT

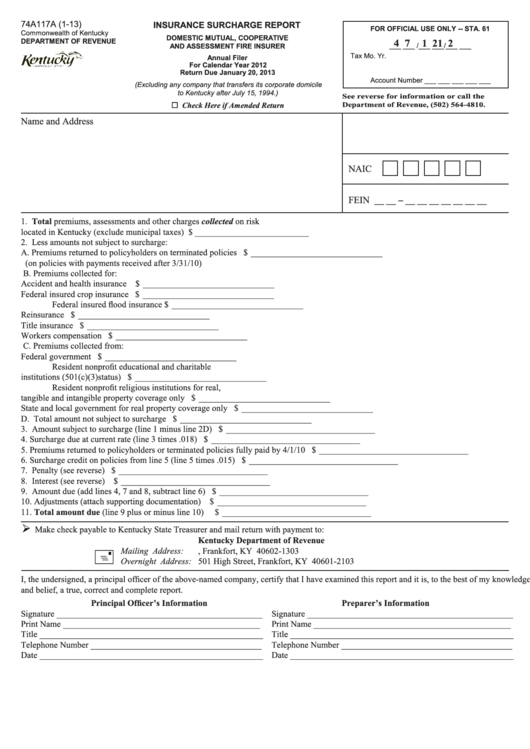

74A117A (1-13)

INSURANCE SURCHARGE REPORT

FOR OFFICIAL USE ONLY -- STA. 61

Commonwealth of Kentucky

DOMESTIC MUTUAL, COOPERATIVE

4 7

1 2

1 2

DEPARTMENT OF REVENUE

___ ___ /___ ___/___ ___

AND ASSESSMENT FIRE INSURER

Tax

Mo.

Yr.

Annual Filer

For Calendar Year 2012

Return Due January 20, 2013

Account Number ___ ___ ___ ___ ___

(Excluding any company that transfers its corporate domicile

to Kentucky after July 15, 1994.)

See reverse for information or call the

Check Here if Amended Return

Department of Revenue, (502) 564-4810.

Name and Address

NAIC

FEIN

__ __ – __ __ __ __ __ __ __

1. Total premiums, assessments and other charges collected on risk

located in Kentucky (exclude municipal taxes) .................................................................................... $ __________________________

2. Less amounts not subject to surcharge:

A. Premiums returned to policyholders on terminated policies ........................... $ ______________________________

(on policies with payments received after 3/31/10)

B. Premiums collected for:

Accident and health insurance ........................................................................ $ ______________________________

Federal insured crop insurance ........................................................................ $ ______________________________

Federal insured flood insurance ....................................................................... $ ______________________________

Reinsurance ..................................................................................................... $ ______________________________

Title insurance ................................................................................................. $ ______________________________

Workers compensation .................................................................................... $ ______________________________

C. Premiums collected from:

Federal government ......................................................................................... $ ______________________________

Resident nonprofit educational and charitable

institutions (501(c)(3)status) ........................................................................... $ ______________________________

Resident nonprofit religious institutions for real,

tangible and intangible property coverage only .............................................. $ ______________________________

State and local government for real property coverage only ........................... $ ______________________________

D. Total amount not subject to surcharge ............................................................. $ ______________________________

3. Amount subject to surcharge (line 1 minus line 2D) ............................................................. $ __________________________________

4.

Surcharge due at current rate (line 3 times .018) ................................................................... $ __________________________________

5. Premiums returned to policyholders or terminated policies fully paid by 4/1/10 ................. $ __________________________________

6. Surcharge credit on policies from line 5 (line 5 times .015) .................................................. $ __________________________________

7. Penalty (see reverse) .............................................................................................................. $ __________________________________

8. Interest (see reverse) ............................................................................................................. $ __________________________________

9. Amount due (add lines 4, 7 and 8, subtract line 6) ................................................................ $ __________________________________

10. Adjustments (attach supporting documentation) .................................................................. $ __________________________________

11. Total amount due (line 9 plus or minus line 10) ................................................................ $ __________________________________

Make check payable to Kentucky State Treasurer and mail return with payment to:

Kentucky Department of Revenue

Mailing Address:

P.O. Box 1303, Frankfort, KY 40602-1303

Overnight Address:

501 High Street, Frankfort, KY 40601-2103

I, the undersigned, a principal officer of the above-named company, certify that I have examined this report and it is, to the best of my knowledge

and belief, a true, correct and complete report.

Principal Officer’s Information

Preparer’s Information

Signature _______________________________________________

Signature _______________________________________________

Print Name _____________________________________________

Print Name _____________________________________________

Title ___________________________________________________

Title ___________________________________________________

Telephone Number _______________________________________

Telephone Number _______________________________________

Date ___________________________________________________

Date ___________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2