Monthly Report-Levy Of Taxes On Food - City Of Covington - 1989

ADVERTISEMENT

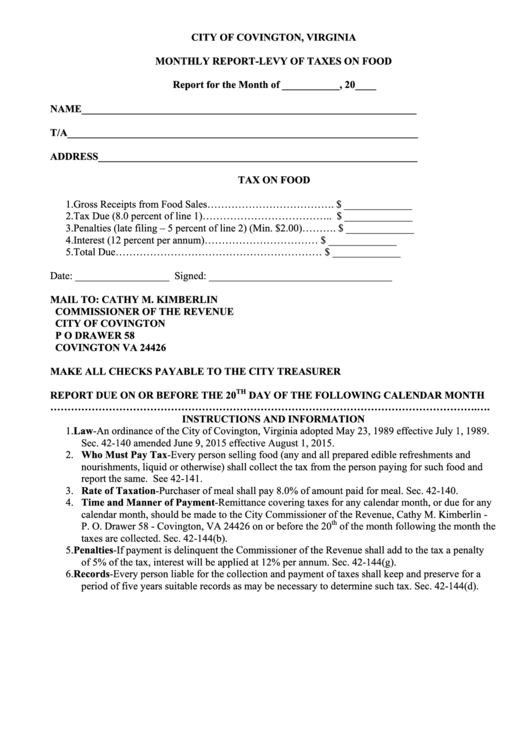

CITY OF COVINGTON, VIRGINIA

MONTHLY REPORT-LEVY OF TAXES ON FOOD

Report for the Month of ___________, 20____

NAME________________________________________________________________

T/A___________________________________________________________________

ADDRESS_____________________________________________________________

TAX ON FOOD

1. Gross Receipts from Food Sales………………………………. $ _____________

2. Tax Due (8.0 percent of line 1)……………………………….. $ _____________

3. Penalties (late filing – 5 percent of line 2) (Min. $2.00)………. $ _____________

4. Interest (12 percent per annum)……………………………...... $ _____________

5. Total Due…………………………………………………….... $ _____________

Date: __________________

Signed: ___________________________________

MAIL TO:

CATHY M. KIMBERLIN

COMMISSIONER OF THE REVENUE

CITY OF COVINGTON

P O DRAWER 58

COVINGTON VA 24426

MAKE ALL CHECKS PAYABLE TO THE CITY TREASURER

TH

REPORT DUE ON OR BEFORE THE 20

DAY OF THE FOLLOWING CALENDAR MONTH

…………………………………………………………………………………………………………….….

INSTRUCTIONS AND INFORMATION

1. Law-An ordinance of the City of Covington, Virginia adopted May 23, 1989 effective July 1, 1989.

Sec. 42-140 amended June 9, 2015 effective August 1, 2015.

2. Who Must Pay Tax-Every person selling food (any and all prepared edible refreshments and

nourishments, liquid or otherwise) shall collect the tax from the person paying for such food and

report the same. See 42-141.

3. Rate of Taxation-Purchaser of meal shall pay 8.0% of amount paid for meal. Sec. 42-140.

4. Time and Manner of Payment-Remittance covering taxes for any calendar month, or due for any

calendar month, should be made to the City Commissioner of the Revenue, Cathy M. Kimberlin -

th

P. O. Drawer 58 - Covington, VA 24426 on or before the 20

of the month following the month the

taxes are collected. Sec. 42-144(b).

5. Penalties-If payment is delinquent the Commissioner of the Revenue shall add to the tax a penalty

of 5% of the tax, interest will be applied at 12% per annum. Sec. 42-144(g).

6. Records-Every person liable for the collection and payment of taxes shall keep and preserve for a

period of five years suitable records as may be necessary to determine such tax. Sec. 42-144(d).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1