Indiana Department Of Insurance Semi-Annual Tax Report Surplus Lines Risks

ADVERTISEMENT

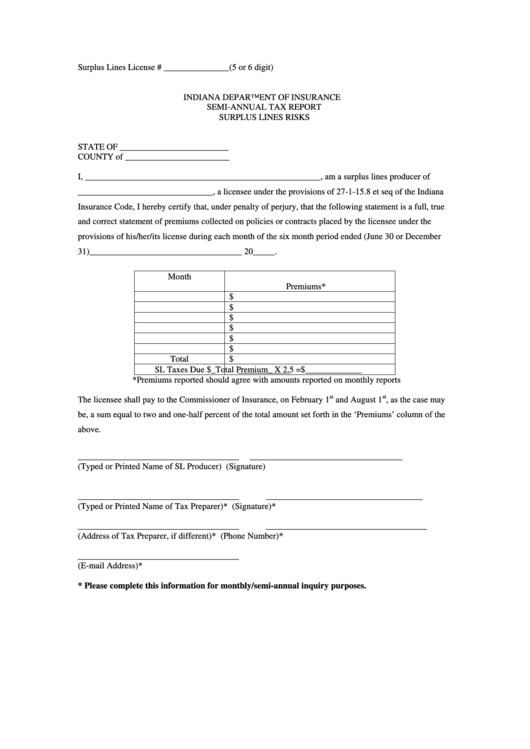

Surplus Lines License # _______________(5 or 6 digit)

INDIANA DEPARTMENT OF INSURANCE

SEMI-ANNUAL TAX REPORT

SURPLUS LINES RISKS

STATE OF _________________________

COUNTY of ________________________

I, ______________________________________________________, am a surplus lines producer of

_______________________________, a licensee under the provisions of 27-1-15.8 et seq of the Indiana

Insurance Code, I hereby certify that, under penalty of perjury, that the following statement is a full, true

and correct statement of premiums collected on policies or contracts placed by the licensee under the

provisions of his/her/its license during each month of the six month period ended (June 30 or December

31)___________________________________ 20_____.

Month

Premiums*

$

$

$

$

$

$

Total

$

SL Taxes Due

$_Total Premium_ X 2.5 =$_____________

*Premiums reported should agree with amounts reported on monthly reports

st

st

The licensee shall pay to the Commissioner of Insurance, on February 1

and August 1

, as the case may

be, a sum equal to two and one-half percent of the total amount set forth in the ‘Premiums’ column of the

above.

_____________________________________

___________________________________

(Typed or Printed Name of SL Producer)

(Signature)

_____________________________________

____________________________________

(Typed or Printed Name of Tax Preparer)*

(Signature)*

_____________________________________

_____________________________________

(Address of Tax Preparer, if different)*

(Phone Number)*

_____________________________________

(E-mail Address)*

* Please complete this information for monthly/semi-annual inquiry purposes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1