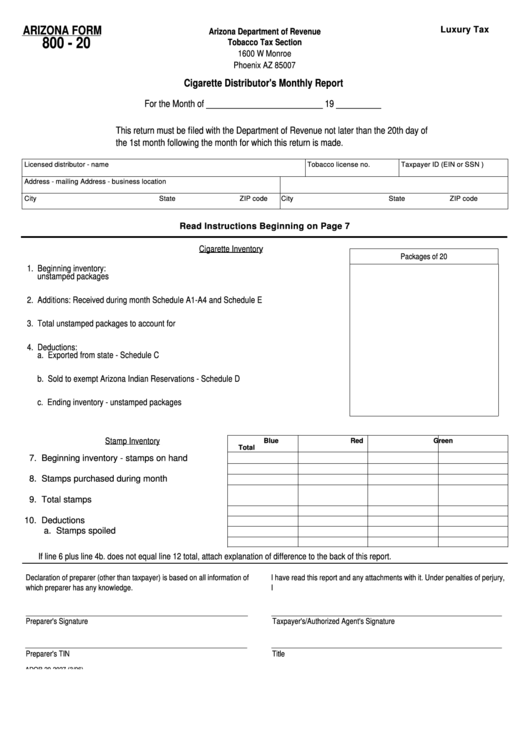

Form 800-20 - Cigarette Distributor'S Monthly Report - 1996

ADVERTISEMENT

ARIZONA FORM

Arizona Department of Revenue

Luxury Tax

800 - 20

Tobacco Tax Section

1600 W Monroe

Phoenix AZ 85007

Cigarette Distributor's Monthly Report

For the Month of __________________________ 19 __________

This return must be filed with the Department of Revenue not later than the 20th day of

the 1st month following the month for which this return is made.

Licensed distributor - name

Tobacco license no.

Taxpayer ID (EIN or SSN )

Address - mailing

Address - business location

City

State

ZIP code

City

State

ZIP code

Read Instructions Beginning on Page 7

Cigarette Inventor y

Packages of 20

1. Beginning inventory:

unstamped packages

.......................................................................................................................................................................................................

2. Additions: Received during month Schedule A1-A4 and Schedule E

..............................................................................................................................

3. Total unstamped packages to account for

.......................................................................................................................................................................

4. Deductions:

a. Exported from state - Schedule C

...............................................................................................................................................................................

b. Sold to exempt Arizona Indian Reservations - Schedule D

........................................................................................................................................

c. Ending inventory - unstamped packages

....................................................................................................................................................................

Stamp Inventory

Blue

Red

Green

Total

7. Beginning inventory - stamps on hand

..............................

8. Stamps purchased during month

......................................

9. Total stamps

available.........................................................

10. Deductions

a. Stamps spoiled

.............................................................

If line 6 plus line 4b. does not equal line 12 total, attach explanation of difference to the back of this report.

Declaration of preparer (other than taxpayer) is based on all information of

I have read this report and any attachments with it. Under penalties of perjury,

which preparer has any knowledge.

I

Preparer's Signature

Taxpayer's/Authorized Agent's Signature

Preparer's TIN

Title

ADOR 20 2027 (3/96)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7