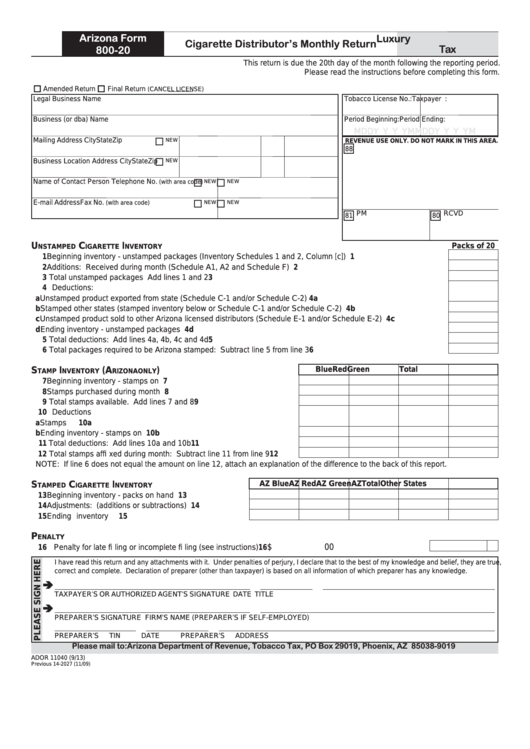

Arizona Form

Luxury

Cigarette Distributor’s Monthly Return

Tax

800-20

This return is due the 20th day of the month following the reporting period.

Please read the instructions before completing this form.

Amended Return

Final Return

(CANCEL LICENSE)

Legal Business Name

Tobacco License No.:

Taxpayer I.D. No.:

Business (or dba) Name

Period Beginning:

Period Ending:

M

M D D Y Y Y Y

M

M D D Y Y Y Y

Mailing Address

City

State Zip

NEW

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

88

Business Location Address

City

State Zip

NEW

Name of Contact Person

Telephone No.

NEW

(with area code)

NEW

E-mail Address

Fax No.

NEW

(with area code)

NEW

81 PM

80 RCVD

U

C

I

Packs of 20

NSTAMPED

IGARETTE

NVENTORY

1 Beginning inventory - unstamped packages (Inventory Schedules 1 and 2, Column [c]) ...................................

1

2 Additions: Received during month (Schedule A1, A2 and Schedule F) .............................................................

2

3 Total unstamped packages Add lines 1 and 2 ...................................................................................................

3

4 Deductions:

a Unstamped product exported from state (Schedule C-1 and/or Schedule C-2).............................................

4a

b Stamped other states (stamped inventory below or Schedule C-1 and/or Schedule C-2) .............................

4b

c Unstamped product sold to other Arizona licensed distributors (Schedule E-1 and/or Schedule E-2) ..........

4c

d Ending inventory - unstamped packages .......................................................................................................

4d

5 Total deductions: Add lines 4a, 4b, 4c and 4d ...................................................................................................

5

6 Total packages required to be Arizona stamped: Subtract line 5 from line 3 .....................................................

6

S

I

(A

)

Blue

Red

Green

Total

TAMP

NVENTORY

RIZONA ONLY

7 Beginning inventory - stamps on hand.............................................

7

8 Stamps purchased during month .....................................................

8

9 Total stamps available. Add lines 7 and 8 .......................................

9

10 Deductions

a Stamps spoiled............................................................................ 10a

b Ending inventory - stamps on hand............................................. 10b

11 Total deductions: Add lines 10a and 10b ........................................ 11

12 Total stamps affi xed during month: Subtract line 11 from line 9 ...... 12

NOTE: If line 6 does not equal the amount on line 12, attach an explanation of the difference to the back of this report.

S

C

I

AZ Blue

AZ Red

AZ Green

AZTotal

Other States

TAMPED

IGARETTE

NVENTORY

13 Beginning inventory - packs on hand ....................... 13

14 Adjustments: (additions or subtractions) ................. 14

15 Ending inventory ...................................................... 15

P

ENALTY

$

00

16 Penalty for late fi ling or incomplete fi ling (see instructions) ......................................................................

16

I have read this return and any attachments with it. Under penalties of perjury, I declare that to the best of my knowledge and belief, they are true,

correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

TAXPAYER’S OR AUTHORIZED AGENT’S SIGNATURE

DATE

TITLE

PREPARER’S SIGNATURE

FIRM’S NAME (PREPARER’S IF SELF-EMPLOYED)

PREPARER’S TIN

DATE

PREPARER’S ADDRESS

Please mail to: Arizona Department of Revenue, Tobacco Tax, PO Box 29019, Phoenix, AZ 85038-9019

ADOR 11040 (9/13)

Previous 14-2027 (11/09)

1

1 2

2 3

3