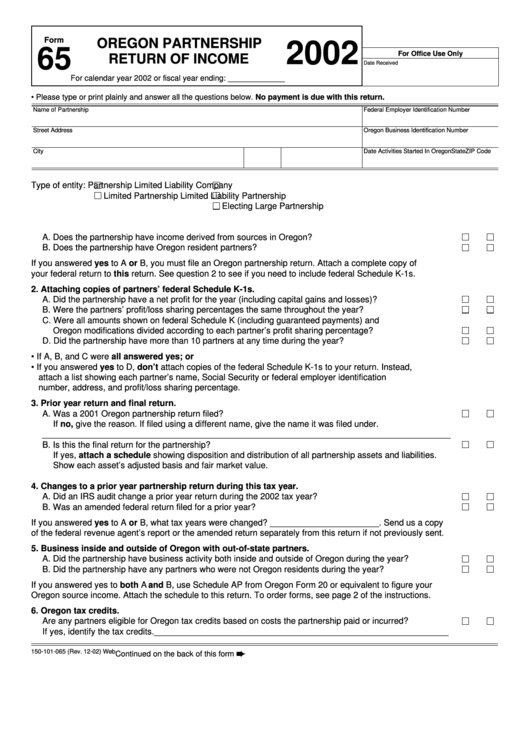

Form 65 - Oregon Partnership Return Of Income - 2002

ADVERTISEMENT

Form

OREGON PARTNERSHIP

2002

65

For Office Use Only

RETURN OF INCOME

Date Received

For calendar year 2002 or fiscal year ending: _____________

• Please type or print plainly and answer all the questions below. No payment is due with this return.

Name of Partnership

Federal Employer Identification Number

Street Address

Oregon Business Identification Number

City

State

ZIP Code

Date Activities Started In Oregon

Type of entity:

Partnership

Limited Liability Company

Limited Partnership

Limited Liability Partnership

Electing Large Partnership

1. Requirement to file Oregon partnership return.

Yes

No

A. Does the partnership have income derived from sources in Oregon? .........................................................

B. Does the partnership have Oregon resident partners? ................................................................................

If you answered yes to A or B, you must file an Oregon partnership return. Attach a complete copy of

your federal return to this return. See question 2 to see if you need to include federal Schedule K-1s.

2. Attaching copies of partners’ federal Schedule K-1s.

A. Did the partnership have a net profit for the year (including capital gains and losses)? ..............................

B. Were the partners’ profit/loss sharing percentages the same throughout the year? ....................................

C. Were all amounts shown on federal Schedule K (including guaranteed payments) and

Oregon modifications divided according to each partner’s profit sharing percentage? ................................

D. Did the partnership have more than 10 partners at any time during the year? ............................................

• If A, B, and C were all answered yes; or

• If you answered yes to D, don’t attach copies of the federal Schedule K-1s to your return. Instead,

attach a list showing each partner’s name, Social Security or federal employer identification

number, address, and profit/loss sharing percentage.

3. Prior year return and final return.

A. Was a 2001 Oregon partnership return filed? ..............................................................................................

If no, give the reason. If filed using a different name, give the name it was filed under.

______________________________________________________________________________________

B. Is this the final return for the partnership? ....................................................................................................

If yes, attach a schedule showing disposition and distribution of all partnership assets and liabilities.

Show each asset’s adjusted basis and fair market value.

4. Changes to a prior year partnership return during this tax year.

A. Did an IRS audit change a prior year return during the 2002 tax year? .......................................................

B. Was an amended federal return filed for a prior year? .................................................................................

If you answered yes to A or B, what tax years were changed? _______________________. Send us a copy

of the federal revenue agent’s report or the amended return separately from this return if not previously sent.

5. Business inside and outside of Oregon with out-of-state partners.

A. Did the partnership have business activity both inside and outside of Oregon during the year? .................

B. Did the partnership have any partners who were not Oregon residents during the year? ...........................

If you answered yes to both A and B, use Schedule AP from Oregon Form 20 or equivalent to figure your

Oregon source income. Attach the schedule to this return. To order forms, see page 2 of the instructions.

6. Oregon tax credits.

Are any partners eligible for Oregon tax credits based on costs the partnership paid or incurred? .................

If yes, identify the tax credits.______________________________________________________________

150-101-065 (Rev. 12-02) Web

Continued on the back of this form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2