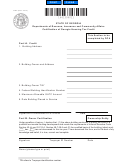

IT-HC

D. Partner is a

General Partner

Limited Partner

Limited Liability

Company Member

E. Partner type is an

Individual

Corporation

Partnership

2

F. Taxpayer’s percentage

of Federal Low Income Housing Credit __________%

2

G. Taxpayer’s percentage

of Georgia Housing Tax Credit ________________%

USAGE OF GEORGIA HOUSING TAX CREDIT

Part III.

FEI / SS# / NAIC # of Taxpayer /Shareholder____________________

Instructions:

In the schedule below, each shareholder, partner or member who receives a

proportionate share of the Georgia Housing Tax Credit should list the amount

claimed/earned each year. Then complete the following lines to arrive at the credit

to be claimed on their tax return. This form will be used to show your credits earned

and used and will be filed with shareholders income tax return or insurance premium

tax return.

The letters TIN appear at certain points on this form and means taxpayer

identification number. The Georgia Housing Tax Credit can only be claimed for

buildings placed in service after January 1, 2001. For the purposes of the Georgia

Housing Tax Credit, transfers of ownership of the credit do not trigger recapture.

However in the case of a transfer, the Commissioner of the Department of Revenue

must be notified. Both the transferer, on the return following the transfer, and the

transferee, on tax returns claiming the credit should check the box indicating transfer

below. There is a three-year carry-forward of unused tax credits.

Check if Transfer has occurred.

2

Enter percentage if known.

2

1

1 2

2 3

3