Form It-Ic - State Of Georgia Investment Tax Credit

ADVERTISEMENT

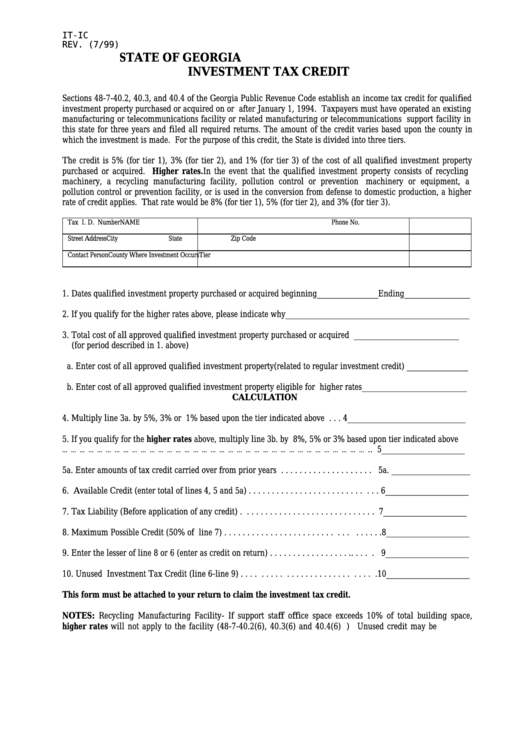

IT-IC

REV. (7/99)

STATE OF GEORGIA

INVESTMENT TAX CREDIT

Sections 48-7-40.2, 40.3, and 40.4 of the Georgia Public Revenue Code establish an income tax credit for qualified

investment property purchased or acquired on or after January 1, 1994. Taxpayers must have operated an existing

manufacturing or telecommunications facility or related manufacturing or telecommunications support facility in

this state for three years and filed all required returns. The amount of the credit varies based upon the county in

which the investment is made. For the purpose of this credit, the State is divided into three tiers.

The credit is 5% (for tier 1), 3% (for tier 2), and 1% (for tier 3) of the cost of all qualified investment property

purchased or acquired. Higher rates. In the event that the qualified investment property consists of recycling

machinery, a recycling manufacturing facility, pollution control or prevention

machinery or equipment, a

pollution control or prevention facility, or is used in the conversion from defense to domestic production, a higher

rate of credit applies. That rate would be 8% (for tier 1), 5% (for tier 2), and 3% (for tier 3).

Tax I. D. Number

NAME

Phone No.

Street Address

City

State

Zip Code

Contact Person

County Where Investment Occurs

Tier

1. Dates qualified investment property purchased or acquired beginning______________Ending_______________

2. If you qualify for the higher rates above, please indicate why__________________________________________

3. Total cost of all approved qualified investment property purchased or acquired ________________________

(for period described in 1. above)

a. Enter cost of all approved qualified investment property(related to regular investment credit) ______________

b. Enter cost of all approved qualified investment property eligible for higher rates________________________

CALCULATION

4. Multiply line 3a. by 5%, 3% or 1% based upon the tier indicated above . . . 4___________________________

5. If you qualify for the higher rates above, multiply line 3b. by 8%, 5% or 3% based upon tier indicated above

… … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … … .. 5___________________

5a. Enter amounts of tax credit carried over from prior years . . . . . . . . . . . . . . . . . . . . 5a. __________________

6. Available Credit (enter total of lines 4, 5 and 5a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6___________________

7. Tax Liability (Before application of any credit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7___________________

8. Maximum Possible Credit (50% of line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8___________________

9. Enter the lesser of line 8 or 6 (enter as credit on return) . . . . . . . . . . . . . . . . . .. . . . . 9___________________

10. Unused Investment Tax Credit (line 6-line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . .10___________________

This form must be attached to your return to claim the investment tax credit.

NOTES: Recycling Manufacturing Facility- If support staff office space exceeds 10% of total building space,

higher rates will not apply to the facility (48-7-40.2(6), 40.3(6) and 40.4(6) O.C.G.A.)

Unused credit may be

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2