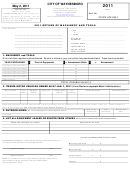

Form Cr-2 - Return Of Machinery And Tools - 2013 Page 2

ADVERTISEMENT

INSTRUCTIONS

Machinery & Tools Return

1. Taxable Value of Machinery & Tools used in the manufacturing process is calculated as

a percentage of cost.

Attach a complete listing of equipment with original cost and year of purchase.

a. Enter cost in appropriate column (year of purchase).

b. Multiply cost (col. A) by assessment ratio (col. B).

c. Enter calculation (col. A x col. B) in assessment column (col. C).

COST VALUES OF ITEMS FULLY DEPRECIATED, MUST BE INCLUDED.

PLEASE ATTACH COPY OF FEDERAL DEPRECIATION SCHEDULE

2. List all tangible Personal Property leased or rented from others.

If none, please so state. Attach list if more space is needed.

3. Signature Required. This form may not be accepted without the signature of the taxpayer or

authorized agent.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2