Form L-72 - Request For Copies Of Income Tax Return - 2001 Page 2

ADVERTISEMENT

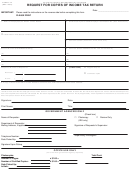

FORM L-72

(REV. 2001)

INSTRUCTIONS

Use this form to request a copy of an income tax return.

If you are not the taxpayer shown in item 1, you must present documentation, such as a Form N-848,

Power of Attorney, or a letter signed by the taxpayer, prior to receiving confidential taxpayer information.

If the taxpayer is deceased, you must present enough evidence to establish that you are authorized to act

for the taxpayer’s estate.

Joint tax returns may be disclosed to either the husband or the wife. Only one signature is required. If

your name has changed, sign your name as it appeared on the return requested, and also sign your

current name. All requests must be signed by the taxpayer or duly authorized agent.

Item 3 — For individuals, enter your social security number (e.g., 000-00-0000). For all other entities,

enter your federal employer identification number (e.g., 00-0000000).

Item 6 — Enter the year(s) of the tax return you are requesting. If requesting more than three documents,

use additional Forms L-72. Returns which were filed before 1986 may not be available for making copies.

Fee — There are two fees which may be charged; a copying fee and a certification fee.

Copying Fee for Returns — One dollar for each page or side of a page reproduced (e.g., one

two-sided document will cost one dollar for each side for a total of $2.00).

Certification Fee — One dollar for each return certified.

Item 8 — If you wish to have the requested income tax return copy sent to someone other than yourself

such as your tax return preparer, enter that person’s name and mailing address on this line.

Where to file. — Send completed Form(s) L-72 to the district tax office with which the original tax return

was filed. You must use a separate form for each District Tax Office from which you are requesting

copies.

Note:

Processing of requests for copies of returns normally takes 15 working days. You will be mailed

a bill when the copies are ready. The copies will be mailed after payment is received.

OAHU DISTRICT OFFICE

HAWAII DISTRICT OFFICE

P. O. Box 259

P. O. Box 833

Honolulu, Hawaii 96809-0259

Hilo, Hawaii 96721-0833

Telephone: (808) 587-1455

Telephone: (808) 974-6321

MAUI DISTRICT OFFICE

KAUAI DISTRICT OFFICE

P. O. Box 1169

3060 Eiwa Street, #105

Wailuku, Hawaii 96793-6169

Lihue, Hawaii 96766-1889

Telephone: (808) 984-8500

Telephone: (808) 274-3456

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2