Individual Tax Return Instructions And Worksheet

ADVERTISEMENT

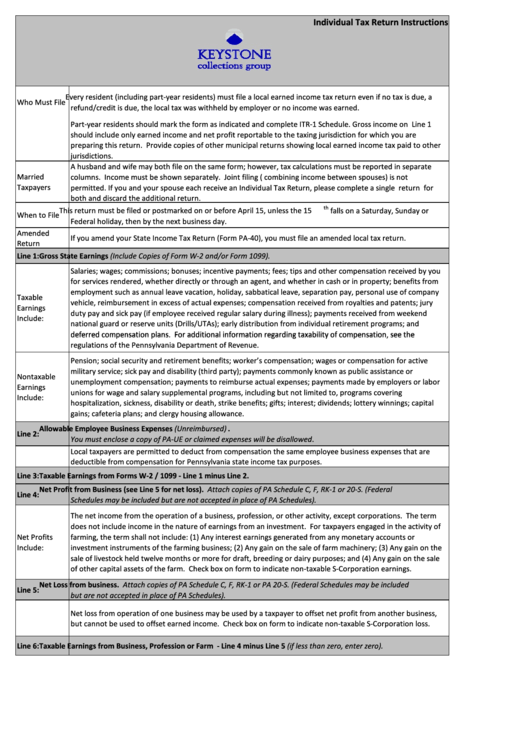

Individual Tax Return Instructions

Every resident (including part-year residents) must file a local earned income tax return even if no tax is due, a

Who Must File

refund/credit is due, the local tax was withheld by employer or no income was earned.

Part-year residents should mark the form as indicated and complete ITR-1 Schedule. Gross income on Line 1

should include only earned income and net profit reportable to the taxing jurisdiction for which you are

preparing this return. Provide copies of other municipal returns showing local earned income tax paid to other

jurisdictions.

A husband and wife may both file on the same form; however, tax calculations must be reported in separate

Married

columns. Income must be shown separately. Joint filing (i.e. combining income between spouses) is not

Taxpayers

permitted. If you and your spouse each receive an Individual Tax Return, please complete a single return for

both and discard the additional return.

This return must be filed or postmarked on or before April 15, unless the 15

falls on a Saturday, Sunday or

th

When to File

Federal holiday, then by the next business day.

Amended

If you amend your State Income Tax Return (Form PA-40), you must file an amended local tax return.

Return

Line 1:

Gross State Earnings (Include Copies of Form W-2 and/or Form 1099).

Salaries; wages; commissions; bonuses; incentive payments; fees; tips and other compensation received by you

for services rendered, whether directly or through an agent, and whether in cash or in property; benefits from

employment such as annual leave vacation, holiday, sabbatical leave, separation pay, personal use of company

Taxable

vehicle, reimbursement in excess of actual expenses; compensation received from royalties and patents; jury

Earnings

duty pay and sick pay (if employee received regular salary during illness); payments received from weekend

Include:

national guard or reserve units (Drills/UTAs); early distribution from individual retirement programs; and

deferred compensation plans. For additional information regarding taxability of compensation, see the

deferred compensation plans. For additional information regarding taxability of compensation, see the

regulations of the Pennsylvania Department of Revenue.

Pension; social security and retirement benefits; worker’s compensation; wages or compensation for active

military service; sick pay and disability (third party); payments commonly known as public assistance or

Nontaxable

unemployment compensation; payments to reimburse actual expenses; payments made by employers or labor

Earnings

unions for wage and salary supplemental programs, including but not limited to, programs covering

Include:

hospitalization, sickness, disability or death, strike benefits; gifts; interest; dividends; lottery winnings; capital

gains; cafeteria plans; and clergy housing allowance.

Allowable Employee Business Expenses (Unreimbursed) .

Line 2:

You must enclose a copy of PA-UE or claimed expenses will be disallowed .

Local taxpayers are permitted to deduct from compensation the same employee business expenses that are

deductible from compensation for Pennsylvania state income tax purposes.

Line 3:

Taxable Earnings from Forms W-2 / 1099 - Line 1 minus Line 2.

Net Profit from Business (see Line 5 for net loss). Attach copies of PA Schedule C, F, RK-1 or 20-S. (Federal

Line 4:

Schedules may be included but are not accepted in place of PA Schedules).

The net income from the operation of a business, profession, or other activity, except corporations. The term

does not include income in the nature of earnings from an investment. For taxpayers engaged in the activity of

Net Profits

farming, the term shall not include: (1) Any interest earnings generated from any monetary accounts or

Include:

investment instruments of the farming business; (2) Any gain on the sale of farm machinery; (3) Any gain on the

sale of livestock held twelve months or more for draft, breeding or dairy purposes; and (4) Any gain on the sale

of other capital assets of the farm. Check box on form to indicate non-taxable S-Corporation earnings.

Net Loss from business. Attach copies of PA Schedule C, F, RK-1 or PA 20-S. (Federal Schedules may be included

Line 5:

but are not accepted in place of PA Schedules).

Net loss from operation of one business may be used by a taxpayer to offset net profit from another business,

but cannot be used to offset earned income. Check box on form to indicate non-taxable S-Corporation loss.

Taxable Earnings from Business, Profession or Farm - Line 4 minus Line 5 (if less than zero, enter zero).

Line 6:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3